Here’s what’s happening in the stock market today:

US stocks are set for a quiet, slightly cautious open today after a powerful rally to new records to start 2026, with traders catching their breath and reassessing AI, geopolitics, and interest-rate expectations. Futures are little changed overall, with mild downside for the Dow and S&P 500 and a steadier tone in tech.

Major indices today 📊

Dow Jones futures are down around 0.1–0.2% after the index hit fresh all‑time highs on Monday, when it jumped roughly 1.2%–1.3%.

S&P 500 futures are roughly flat to down about 0.1%, signaling a pause after recent gains as the year’s first full trading week gets going.

Nasdaq 100 futures are mixed to slightly higher (around +0–0.2%) as traders rotate back into big tech and AI‑linked names after Monday’s advance.

Market movers 🚀

Nvidia and AMD are in focus after showcasing new AI‑related products and strategies at CES, which helped fuel Monday’s tech and AI enthusiasm and continue to anchor sentiment today.

Oil and energy stocks such as Chevron, ExxonMobil, and ConocoPhillips are attracting interest after strong gains tied to optimism about access to Venezuela’s oil sector and the broader energy outlook.

Semiconductor names including Micron, TSMC, and Intel remain supported as investors bet on ongoing demand for AI and memory chips into 2026.

Key events driving the market 🗞️

Geopolitical tension around the U.S. seizure and subsequent legal drama involving Venezuela’s President Nicolás Maduro is on the radar but has not derailed risk appetite, with many investors instead eyeing potential opportunities for U.S. energy and defense firms.

Focus is turning to this week’s labor‑market data and the upcoming jobs report, which will help shape expectations for how quickly the Federal Reserve may cut interest rates this year.

CES headlines, especially around AI, robotics, and chip demand, are serving as a key narrative driver for growth and tech stocks early in the year.

Other markets: oil, gold, and bonds 🛢️💰

Crude oil prices are ticking higher, with WTI up around 0.5% and trading near its highest level in about a month as traders weigh possible supply and investment shifts linked to Venezuela.

Gold and silver futures are climbing again and hovering near record territory as some investors hedge geopolitical risk while staying broadly constructive on equities.

Treasury yields are holding in a moderate range, keeping the backdrop supportive for stocks but still competitive versus risk assets as markets look ahead to incoming economic data.

Investor sentiment 👀

Overall mood appears cautious but still risk‑on: traders are digesting a sharp early‑year rally, rich index levels, and elevated AI optimism while watching geopolitics and the Fed path.

Dips are still widely seen as buyable as long as growth, earnings, and rate‑cut expectations remain intact, which keeps volatility contained even on days when futures soften.

TRADE OF THE DAY:

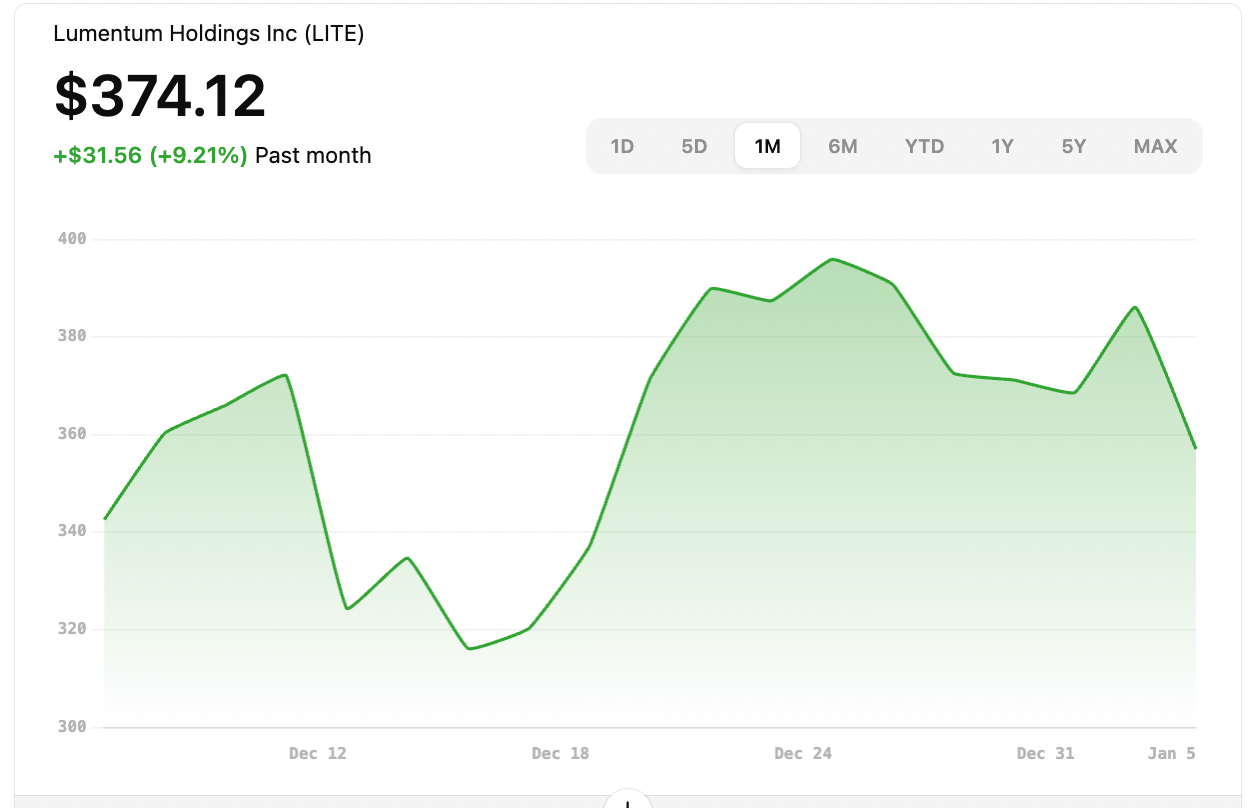

LITE

Name: Lumentum Holdings Inc.

Symbol: LITE

Current Price: Approximately $374.12 (latest market data)

Trade

Sell to Open: 1 LITE Jan 23, 2026 300/295 Put Vertical

Total Credit Received: $60.00

Credit per Contract: $60.00

Direction: Bullish

Probability of Profit (PoP): 85.47%

Potential ROI:

Max Risk (Loss): $440.00

ROI: ($60.00 ÷ $440.00) × 100 ≈ 13.6%

Trade Explained in Simple English:

You sold a 300/295 put vertical on LITE expiring January 23, 2026, collecting $60 upfront. This bullish trade profits if LITE stays above about $299.20 at expiration. Your risk is capped at $440 if the stock falls to or below 295, while your potential reward is the credit received.

Wall Street Highlights:

News Beyond the Numbers

Several big U.S. banks are stepping up preparations for potential new regulations and capital rules under the Trump administration, prompting fresh lobbying efforts in Washington.

Read more.Utility and energy companies with large Wall Street followings are reshuffling portfolios in response to shifting expectations for Federal Reserve policy and long-term interest rates.

Read more.Wall Street dealmakers are closely tracking Vistra’s roughly $4.7 billion agreement to acquire Ogent Energy from Capital Group, highlighting renewed appetite for large power-sector M&A.

Read more.Microchip Technology drew strong attention from Wall Street analysts after the company lifted its third‑quarter sales outlook on the back of robust demand in automotive and industrial chips.

Read more.Major financial institutions are analyzing the impact of President Trump’s plan to send U.S. oil drillers into Venezuela, seeing potential openings for financing and energy‑related investment banking mandates.

Read more.

Disclaimer: The content provided by OptionPicks is for informational and educational purposes only and should not be construed as investment, financial, legal, or tax advice. We are not registered as a broker-dealer, investment adviser, or financial advisor with the SEC, FINRA, or any other regulatory authority. Options trading involves substantial risk and is not suitable for every investor. Past performance is not indicative of future results, and no representation is being made that any subscriber will or is likely to achieve profits or incur losses similar to those mentioned. You should consult with a licensed financial professional before making any investment decisions.