Here’s what’s happening in the stock market today:

Stock futures point to a steady open today following record highs for the Dow Jones Industrial Average and S&P 500 yesterday. Markets remain resilient amid upcoming economic data releases, though some caution lingers from global developments.

Major Indices 📊

Dow Jones futures edge up 0.1%, building on yesterday's close above 49,000.

S&P 500 futures dip slightly by 0.1%, off a fresh record high.

Nasdaq futures slip 0.2-0.3%, reflecting tech sector pullback pressures.

Market Movers 🚀

Tech hardware names like Micron and Broadcom continue strong momentum from recent gains. Gold retreats to around $4,460 per ounce after prior surges, while Bitcoin hovers near $92,000.

Key Influences 🗞️

Treasury yields ease to 4.14% on the 10-year note, supporting equities versus bonds. Investors eye today's jobs data, ISM services PMI, and durable goods orders for Fed rate cut clues.

Investor Sentiment 👀

Trading stays balanced with low volatility, as markets digest U.S. oil import plans from Venezuela and nuclear energy boosts. Optimism prevails for 2026, tempered by data dependencies.

TRADE OF THE DAY:

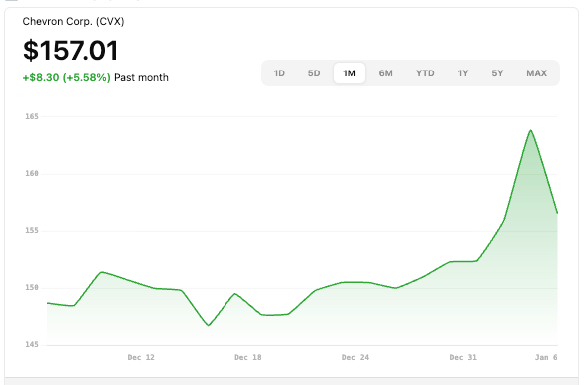

CVX

Name: Chevron Corporation

Symbol: CVX

Current Price: Approximately $157.00

Trade

Sell to Open: 1 CVX Jan 23, 2026 150/145 Put Vertical

Total Credit Received: $46.00

Credit per Contract: $46.00 (assumes 1 contract = 100 shares)

Direction: Bullish

Probability of Profit (PoP): 83.71%

Potential ROI:

Max Risk (Loss): $454.00

ROI: ($46.00 ÷ $454.00) × 100 ≈ 10.1%

Trade Explained in Simple English:

You’re selling a bullish put credit spread on Chevron by selling the 150 put and buying the 145 put, both expiring January 23, 2026. You collect $46 upfront, and the trade is profitable as long as CVX stays above about $149.54 at expiration. Your maximum profit is limited to the $46 credit received, while your maximum loss is capped at $454 if the stock falls below $145. This is a conservative bullish trade with a high probability of success but a relatively small return.

Wall Street Highlights:

News Beyond the Numbers

Oil prices fell sharply after President Trump announced that Venezuela will supply crude to the U.S., easing supply concerns amid geopolitical tensions. Read more.

Semiconductor stocks surged on AI optimism, with chipmakers like those in the SOX index climbing toward new highs ahead of CES events. Read more.

Silver prices hit a record high of $66.5 per ounce, up 130% this year, as traders sought safe-haven assets amid market uncertainty. Read more.

Trump administration trade tariff revenues are tracking well below White House expectations, according to research from Pantheon. Read more.

EV stocks face ongoing volatility due to production cost pressures and shifting investor focus toward profitability over growth. Read more.

Disclaimer: The content provided by OptionPicks is for informational and educational purposes only and should not be construed as investment, financial, legal, or tax advice. We are not registered as a broker-dealer, investment adviser, or financial advisor with the SEC, FINRA, or any other regulatory authority. Options trading involves substantial risk and is not suitable for every investor. Past performance is not indicative of future results, and no representation is being made that any subscriber will or is likely to achieve profits or incur losses similar to those mentioned. You should consult with a licensed financial professional before making any investment decisions.