Here’s what’s happening in the stock market today:

The stock market is opening with little changed to slightly lower futures amid anticipation for big tech earnings this week and the Federal Reserve's interest rate decision. 📉⏳ Gold has surged past $5,000 for the first time, driven by tariff threats and safe-haven demand, while major indexes like the S&P 500 and Dow have declined for two straight weeks. Investors remain cautious after a volatile period marked by political risks and mixed economic signals.

Major Indices Performance 📊

S&P 500 futures are little changed ahead of key events, following Friday's close up 0.03% at 6,915.61.

Dow Jones futures show modest declines around 0.1-0.6%, with recent levels near 49,119.

Nasdaq futures are inching lower by about 0.1%, reflecting tech sector jitters before earnings from Apple, Meta, and Microsoft.

Market Movers 🚀

Life360 surged 24% to $68.10 in pre-market trading.

EquipmentShare climbed over 32% to $32.56, leading gainers amid high volume.

Other notables include Movano (up 140% recently) and TeraWulf (up 9.5%), while losers like Intel dropped 17% pre-open.

Mining and metals stocks like Avino Silver & Gold gained around 19%.

Key Events Driving the Market 🗞️

The Federal Reserve meets this week, expected to hold rates steady amid sticky inflation and a cooling jobs market, with Chair Powell's comments in focus.

Big tech earnings from Microsoft, Apple, Meta, and others kick off, alongside risks of a U.S. government shutdown over budget disputes.

Tariff threats from President Trump, including on Canada and Greenland tensions, continue fueling volatility and boosting gold.

Investor Sentiment 👀

Traders are subdued, balancing optimism from AI-driven tech strength against policy uncertainties like Fed pauses and fiscal risks. 🐂⚖️ Markets eye potential de-escalation but brace for swings from earnings and geopolitics.

TRADE OF THE DAY:

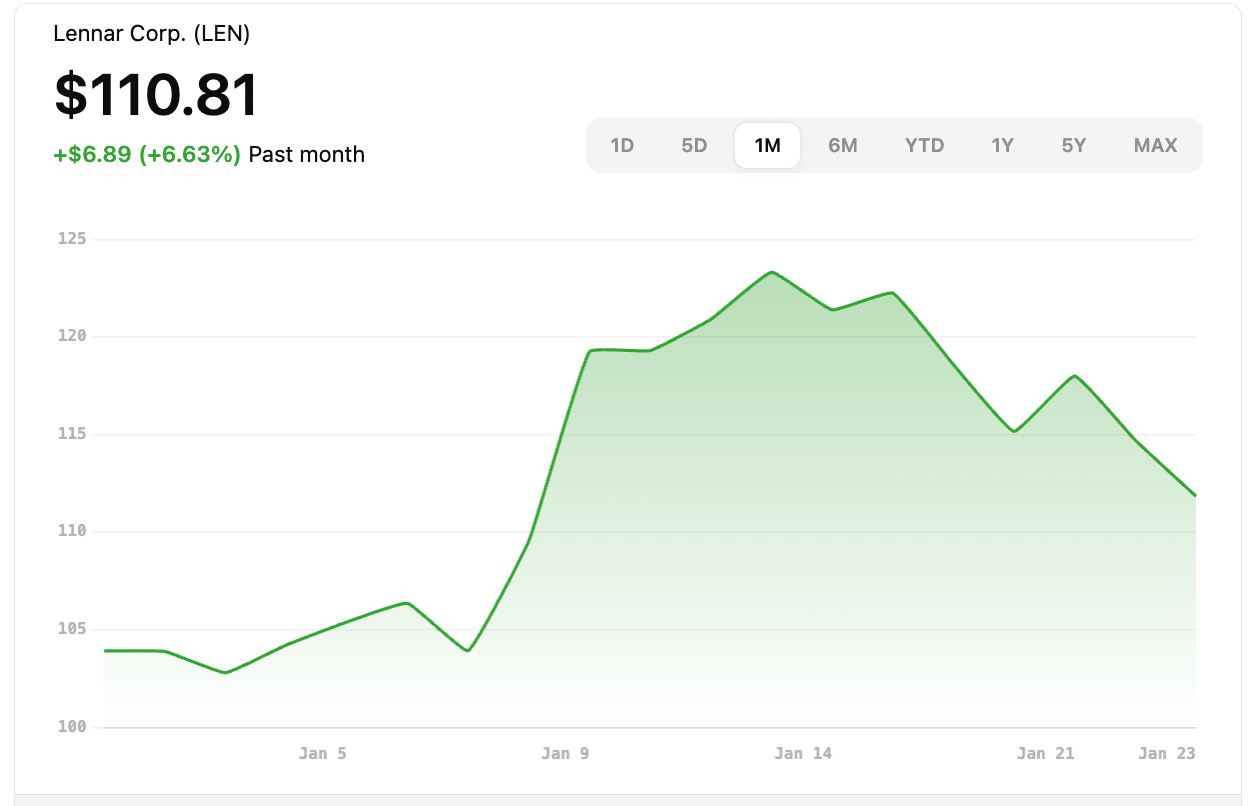

LEN

Name: Lennar Corporation

Symbol: LEN

Current Price: Approximately ~$110.81

Trade

Sell to Open: 1 LEN Feb 13, 2026 101/96 Put Vertical

Total Credit Received: $63.00

Credit per Contract: $63.00 (for one contract covering 100 shares)

Direction: Bullish (expects LEN to stay above the break-even level)

Probability of Profit (PoP): 85.15%

Potential ROI:

Max Risk (Loss): $437.00

ROI: ($63 ÷ $437) × 100 ≈ 14.4%

Trade Explained in Simple English:

This trade involves selling the 101 strike put and buying the 96 strike put on LEN, both expiring February 13, 2026. You collect $63 upfront for entering the spread. The position is profitable if LEN stays above $100.37 at expiration, allowing both options to expire worthless. Your potential profit is capped at $63, while your maximum loss is limited to $437, making this a defined-risk bullish strategy.

Wall Street Highlights:

News Beyond the Numbers

Merck & Co. has ended talks to acquire biotech firm Revolution Medicines after failing to agree on a price that could have valued the deal at around $30 billion. Read more.

Capital One Financial reported Q4 2025 adjusted earnings of $3.86 per share, missing analyst estimates of $4.12, while revenues of $15.58 billion exceeded expectations. Read more.

JPMorgan and Goldman Sachs strategists observe early signs of US corporate earnings broadening beyond mega-cap tech stocks into the wider S&P 500. Read more.

Ocean First Financial and Flushing Financial agreed to an all-stock merger valued at $579 million, creating a bank with $23 billion in assets across New Jersey and New York. Read more.

SoftBank acquired DigitalBridge for $4 billion to expand its AI digital infrastructure capabilities amid surging cloud computing demand. Read more.

Disclaimer: The content provided by OptionPicks is for informational and educational purposes only and should not be construed as investment, financial, legal, or tax advice. We are not registered as a broker-dealer, investment adviser, or financial advisor with the SEC, FINRA, or any other regulatory authority. Options trading involves substantial risk and is not suitable for every investor. Past performance is not indicative of future results, and no representation is being made that any subscriber will or is likely to achieve profits or incur losses similar to those mentioned. You should consult with a licensed financial professional before making any investment decisions.