Here’s what’s happening in the stock market today:

US stock futures point to a lower open today amid a commodity selloff in precious metals and hawkish signals from President Trump's Fed Chair nominee Kevin Warsh. 📉⏳ Markets are reacting to higher Treasury yields around 4.24% and uncertainty over Fed policy easing, following Friday's declines where the S&P 500 fell 0.4% and Nasdaq dropped 0.9%.

Major Indices 📊

S&P 500 futures down 0.37% to 6,940, signaling caution after recent record highs near 7,000.

Dow Jones futures off 0.07% around 48,973, with the index closing Friday at 48,892.

Nasdaq 100 futures decline 0.66% to 25,501, hit by tech weakness and AI spending concerns.

Market Movers 🚀

Tech giants like Nvidia and Tesla down nearly 2% in premarket, alongside Meta, Alphabet, Microsoft, and Amazon losses of 0.5-1%.

Recent Friday movers included Verizon up 11.8% and Robert Half surging 27.8%, while Unity Software plunged 24%.

No standout premarket gainers yet amid broad caution; watch volume in high-beta names.

Key Events 🗞️

President Trump's nomination of Kevin Warsh as next Fed Chair boosts yields and pressures stocks, viewed as hawkish on easing.

Commodity rout hits gold/silver hard, spilling into risk assets and lifting VIX to 19.11 near two-week highs.

10-year Treasury yield steady at 4.24% after rising on policy speculation, competing with equities.

Investor Sentiment 👀

Traders cautious with elevated volatility and policy risks overshadowing January gains; focus on Fed trajectory and earnings ahead. 🐻⚖️ Premarket volume subdued as investors digest Warsh pick and metal unwind.

Can this idea actually make money?

The fastest way to find out is simple — launch a newsletter and website in minutes, then turn what you know into something people can buy.

With beehiiv’s Digital Product Suite, your expertise becomes real products: a short guide, a playbook, a set of templates, or limited access to your time. No friction, and no code required. Just create, price it, and share it with your audience.

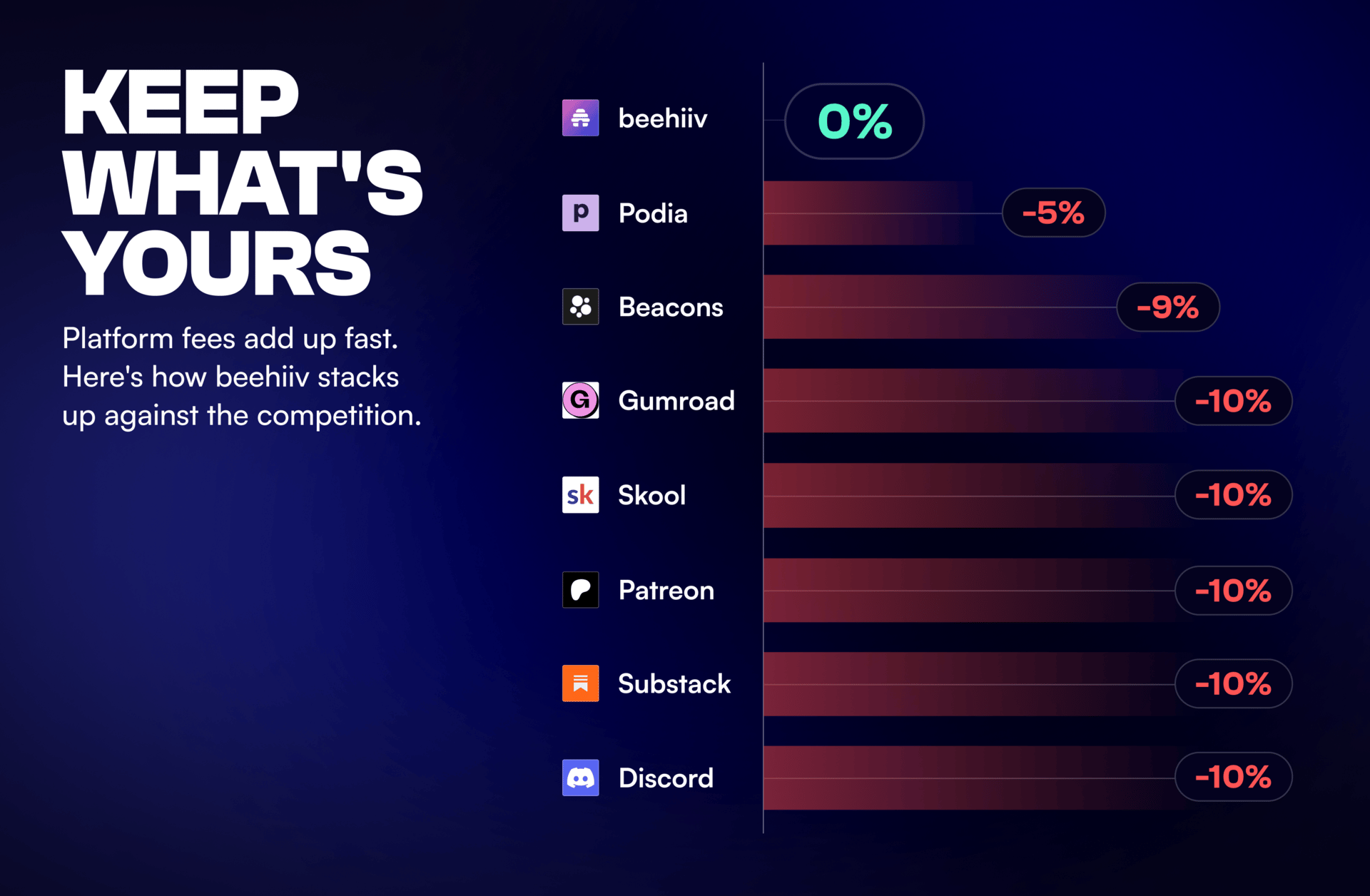

And unlike other platforms that quietly take 5–10% of every sale, beehiiv takes 0%. What you earn is yours to keep.

For a limited time, get 30% off your first 3 months on beehiiv with code PRODUCT30.

TRADE OF THE DAY:

BRK/B

Name: Berkshire Hathaway Inc. Class B

Symbol: BRK.B

Current Price: Approximately $485.00

Trade

Sell to Open: 1 BRK.B Feb 20, 2026 500/505 Call Vertical

Total Credit Received: $59.00

Credit per Contract: $59.00 (1 contract = 100 shares)

Direction: Bearish (expects BRK.B to stay below the short call strike)

Probability of Profit (PoP): 84.21%

Potential ROI:

Max Risk (Loss): $441.00

ROI: ($59 ÷ $441) × 100 ≈ 13.4%

Trade Explained in Simple English:

You’re selling a bearish call credit spread by selling the 500 call and buying the 505 call on BRK.B, both expiring February 20, 2026. You collect $59 upfront, and the trade is profitable if the stock stays below about $500.59 at expiration. Your maximum profit is the $59 credit received, while your maximum loss is capped at $441 if BRK.B finishes above $505. This strategy benefits from the stock staying flat or moving lower over time.

Wall Street Highlights:

News Beyond the Numbers

President Trump nominated Kevin Warsh as the next Federal Reserve chair, sparking intense debate among investors over potential shifts in U.S. interest-rate policy and monetary tightening.

Read more.Oracle announced plans to raise $50 billion this year to fuel its artificial-intelligence development, drawing keen investor attention ahead of Big Tech earnings season.

Read more.Elon Musk's SpaceX and xAI are exploring a major merger to combine rocket technology with artificial intelligence capabilities, marking another bold integration of his business empire.

Read more.Rural communities across the U.S. are resisting AI data-center projects over concerns about surging utility costs, job losses, and privacy risks, delaying expansions nationwide.

Read more.GameStop CEO Ryan Cohen unveiled an audacious acquisition strategy aimed at securing his $35 billion payday, with 'Big Short' investor Michael Burry voicing strong support.

Read more.

Disclaimer: The content provided by OptionPicks is for informational and educational purposes only and should not be construed as investment, financial, legal, or tax advice. We are not registered as a broker-dealer, investment adviser, or financial advisor with the SEC, FINRA, or any other regulatory authority. Options trading involves substantial risk and is not suitable for every investor. Past performance is not indicative of future results, and no representation is being made that any subscriber will or is likely to achieve profits or incur losses similar to those mentioned. You should consult with a licensed financial professional before making any investment decisions.