Here’s what’s happening in the stock market today:

📉 The S&P 500 is down about 0.4%—tech stocks are leading the losses, especially big names in AI like Nvidia and Meta, as investors question if the AI boom will really deliver the big returns everyone expects.

💼 The Dow Jones is holding steady, avoiding the steep drops seen in tech-heavy indexes, as investors shift money into safer sectors like energy, healthcare, and consumer staples.

👀 All eyes are on the Federal Reserve, with a big speech expected from Chair Jerome Powell at the Jackson Hole summit. Many investors are hoping for hints about interest rate cuts later this year, but recent inflation data has made the outlook less certain.

📊 Corporate earnings continue to shake up the market. Target’s stock dropped after reporting another sales decline, while companies like TJ Maxx and Hormel Foods saw gains thanks to good results and upbeat forecasts.

🌎 Globally, some markets like India’s Nifty index are pushing higher, with strong sectors in pharma and real estate, but autos and FMCG are lagging behind.

In summary: The market’s focused on tech sell-offs, rate cut hopes, and upcoming economic data, making for a cautious but eventful trading day! 🚦💹

TRADE OF THE DAY:

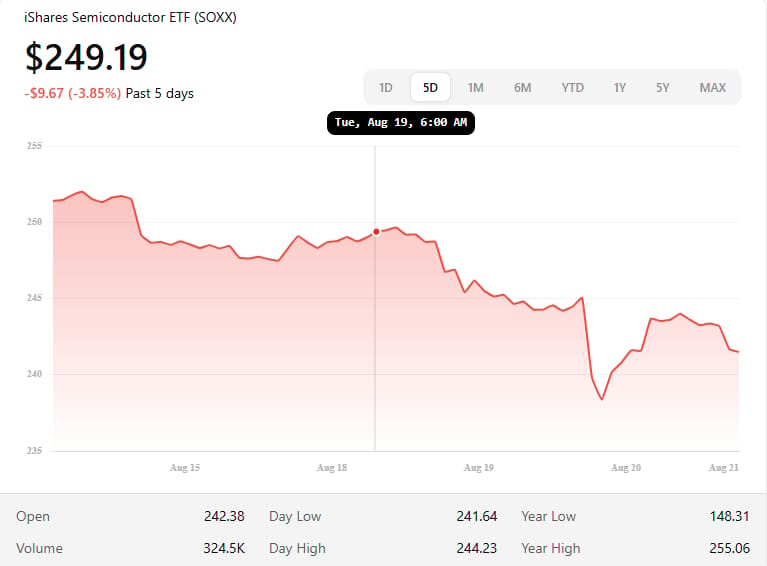

SOXX

SOXX Chart

Name: iShares Semiconductor ETF (via BlackRock Institutional Trust Company N.A.)

Symbol: SOXX

Current Price: Approximately $241.73

Trade

Sell to Open: 1 SOXX Sep 26, 2025 240/227.5 Put Vertical (Bull Put)

Total Credit Received: $450.00

Credit per Contract: $450.00 (for one contract covering 100 shares)

Direction: Bullish (expects SOXX to stay above break-even level)

Probability of Profit (PoP): 60.16% (as provided)

Potential ROI:

Max Risk (Loss): $800.00

ROI: ($450/$800)×100(\$450 / \$800) × 100($450/$800)×100% ≈ 56.3%

Trade Explained in Simple English:

You're entering a put vertical spread by selling a put at the 240 strike and buying a protective put at the 227.5 strike, both expiring September 26, 2025. You receive $450 upfront. If SOXX stays above about $235.50 (your break-even), both puts expire worthless and you keep the $450

Your maximum loss is capped at $800 if the ETF falls below $227.50 at expiration. You believe there's about a 60% chance this trade finishes in the money for you.

Wall Street Highlights:

News Beyond the Numbers

Walmart raises its yearly profit outlook but stock dips after cautious sales guidance and tariff concerns.

https://www.reuters.com/business/wall-street-set-lower-open-with-fed-meet-focus-walmart-slides-2025-08-21/Beauty brand Coty suffers a surprise loss; shares plunge over 20% after reporting an 8% sales decline and tariff pressures.

https://www.the-journal.com/articles/wall-street-ticks-lower-as-more-earnings-come-in-ahead-of-fed-chair-powells-speech/U.S. and EU roll out a new trade agreement, shifting attention to international economic diplomacy.

https://www.investopedia.com/5-things-to-know-before-the-stock-market-opens-august-21-2025-11794979Meta (Facebook’s parent) reportedly halts its artificial intelligence hiring over cost concerns, signaling a pause in rapid AI investment.

https://www.investopedia.com/5-things-to-know-before-the-stock-market-opens-august-21-2025-11794979CME Group and Flutter Entertainment’s FanDuel team up to launch “event contracts” pegged to financial and economic outcomes.

https://www.investopedia.com/5-things-to-know-before-the-stock-market-opens-august-21-2025-11794979Fear grows on Wall Street about potential threats to the Federal Reserve’s independence, driven by political pressure and looming inflation.

https://fortune.com/2025/08/21/wall-street-end-of-fed-independence/Tariff rates on U.S. imports surge to 16% from last month’s 11%, putting the spotlight on policy risks and consumer costs.

https://fortune.com/2025/08/21/wall-street-end-of-fed-independence/Crypto market watch: Despite overall calm, August exposes fragility in bonds and some digital currencies like Bitcoin.

https://finance.yahoo.com/video/august-slowdown-bond-crypto-movements-220000206.htmlBeauty and cosmetics firm Coty faces margin pressure, tying weak sales outlook directly to tariff impact.

https://wtop.com/world/2025/08/asian-shares-are-mostly-higher-after-a-mixed-finish-on-wall-street/Mortgage occupancy fraud rises, highlighted in today’s print edition Wall Street Journal, shining a light on new real estate risks.

https://www.wsj.com/print-edition/20250821/us