Here’s what’s happening in the stock market today:

The stock market is showing modest gains today, with U.S. futures pointing higher after the release of August consumer inflation data that was slightly hotter than expected. 📈 The S&P 500 and Nasdaq futures are up about 0.2-0.3%, while Dow futures are marginally higher. Major indices are hovering near record levels as investors digest inflation figures and prepare for the Federal Reserve's upcoming rate decision. 🏦💹

Major Indices Performance 📊

S&P 500 is up slightly, trading near all-time highs.

Dow Jones Industrial Average is also higher by about 0.3%.

Nasdaq futures gained around 0.2%, continuing its positive momentum.

Market Movers 🚀

Oracle continues to rally strongly following a substantial gain yesterday fueled by optimistic cloud division guidance and AI sector enthusiasm.

Klarna saw a notable debut surge in New York, gaining about 30% in its IPO.

Adobe, Kroger, and RH are reporting earnings today, attracting investor attention.

Key Events Driving the Market 🗞️

August CPI inflation rose 2.9% year-over-year, slightly above expectations, but the market remains optimistic about a Fed interest rate cut next week given weakening labor market signals.

Initial jobless claims ticked up, suggesting some softening in U.S. employment conditions.

The European Central Bank is expected to hold rates steady today, contrasting with the Fed's likely rate cut.

Investor Sentiment 👀

The overall mood is cautiously optimistic with investors awaiting more clarity from upcoming earnings and the Fed's next move.

AI-related stocks continue to drive excitement, while inflation data adds some uncertainty to the near-term outlook.

Trading volumes remain steady, with market participants balancing positive economic data against inflation concerns. 🐂📈

This blend of inflation data impact, Fed expectations, and earnings focus is shaping a slightly positive but watchful market tone today.

TRADE OF THE DAY:

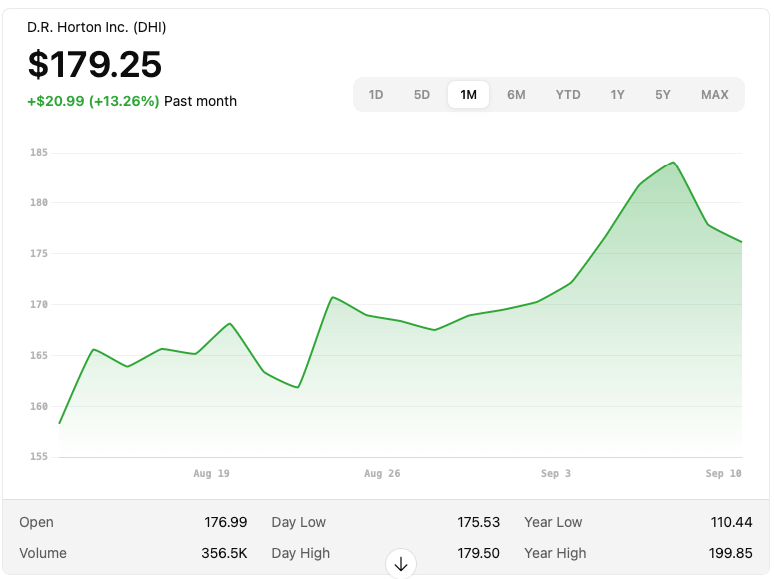

DHI

Name: D.R. Horton, Inc.

Symbol: DHI

Current Price: ~$179.25

Trade

Sell to Open: 1 DHI Oct 10, 2025 162.50/157.50 Put Vertical

Total Credit Received: $57.00

Credit per Contract: $57.00

Direction: Bullish (a put vertical expecting stock to stay above break-even)

Probability of Profit (PoP): 86.17% (as provided)

Potential ROI:

Max Risk (Loss): $443.00

ROI: ($57 ÷ $443) × 100 ≈ 12.9%

Trade Explained in Simple English:

You are selling the 162.50 strike put and buying the 157.50 strike put in DHI, both expiring Oct 10, 2025 (a put vertical spread). You receive $57 upfront. If DHI closes above about $161.93 at expiration, both puts expire worthless and you keep the credit. Your maximum loss is capped at $443 if DHI falls below $157.50. Since you expect the stock to stay above the short strike, this is a bullish strategy.

Wall Street Highlights:

News Beyond the Numbers

Centene rallies 10% after confirming financial performance through August aligns with its full-year guidance.

https://www.reuters.com/business/wall-st-advances-fed-rate-cut-bets-remain-intact-after-inflation-data-2025-09-11/Micron Technology jumps 10.3% following Citigroup's price target hike to $175, boosting semiconductor sector optimism.

https://www.reuters.com/business/wall-st-advances-fed-rate-cut-bets-remain-intact-after-inflation-data-2025-09-11/Oracle stock drops 2.6% in early trading after surging nearly 36% on a bullish AI-cloud forecast.

https://www.reuters.com/business/wall-st-advances-fed-rate-cut-bets-remain-intact-after-inflation-data-2025-09-11/Gun stocks rise following a tragic shooting incident in Utah, with Sturm Ruger and Smith & Wesson gaining 3.1% and 2.8% respectively.

https://www.reuters.com/business/wall-st-set-muted-open-inflation-data-keeps-september-rate-cut-bets-firm-2025-09-11/Shares of Sharplink Gaming and Bitmine Immersion Technologies advance alongside gains in the cryptocurrency Ether.

https://www.reuters.com/business/wall-st-set-muted-open-inflation-data-keeps-september-rate-cut-bets-firm-2025-09-11/Buy now, pay later company Klarna shares dip slightly after a strong market debut yesterday.

https://www.investopedia.com/5-things-to-know-before-the-stock-market-opens-september-11-2025-11807892Opendoor shares surge 36% after appointing Shopify’s COO Kaz Nejatian as CEO and board leadership changes.

https://wtop.com/world/2025/09/asian-shares-are-mostly-up-after-us-stocks-inch-to-more-records-as-inflation-slows-and-oracle-soars/FedEx and UPS stocks decline after Bank of America downgrades both package delivery companies.

https://wtop.com/world/2025/09/asian-shares-are-mostly-up-after-us-stocks-inch-to-more-records-as-inflation-slows-and-oracle-soars/Broadcom and Nvidia shares jump 9.8% and 3.9% on investor enthusiasm for AI and semiconductor demand.

https://finviz.com/news/163746/stock-market-news-for-sep-11-2025Ooor Technologies surges after appointing a Shopify executive as CEO, signaling strategic leadership change.

https://www.investopedia.com/5-things-to-know-before-the-stock-market-opens-september-11-2025-11807892