Here’s what’s happening in the stock market today:

The stock market today shows cautious optimism as investors position for the Federal Reserve's interest rate decision scheduled for tomorrow. 📈 The S&P 500 and Nasdaq are opening slightly higher, each poised to extend recent record-setting runs, while the Dow remains essentially flat. 🏦 The market mood is balanced, with gains weighed against lingering inflation and labor market concerns. 💹

Major Indices Performance 📊

S&P 500 trades just above 6,600, near record highs.

Nasdaq Composite is up modestly, aiming for its 10th consecutive all-time high.

Dow Jones Industrial Average holds relatively steady with minimal movement.

Market Movers 🚀

Tesla shares climbed about 2% after Elon Musk bought $1 billion in stock, reversing recent losses. ⚡

Oracle and Alphabet maintain strong momentum after recent gains.

Premarket movers include Ferguson Enterprises (+9%) and ANGX (+12.5%) among notable gainers, while some smaller stocks face declines.

Key Events Driving the Market 🗞️

The Federal Reserve's two-day meeting is the main focus; a 25 basis-point rate cut is widely expected to address a cooling labor market despite persistent inflation. 🔔

Retail sales for August came in as forecasted, supporting consumer resilience but also reflecting import tariff impacts. 🛒

Senate confirmation of Stephen Miran to the Fed Board and ongoing trade talks between Trump and Xi Jinping add political context.

Investor Sentiment 👀

Trading volumes are moderate as participants await clearer signals from the Fed's policy announcement.

Global markets show measured gains while cautiousness persists due to economic uncertainties.

Gold surged to an all-time high, reflecting safe-haven demand amid rate cut anticipation. 🪙

Overall, today’s trading features slight gains and steady indices as markets digest economic data and ready for the Fed’s policy decision tomorrow. 🐂📈

TRADE OF THE DAY:

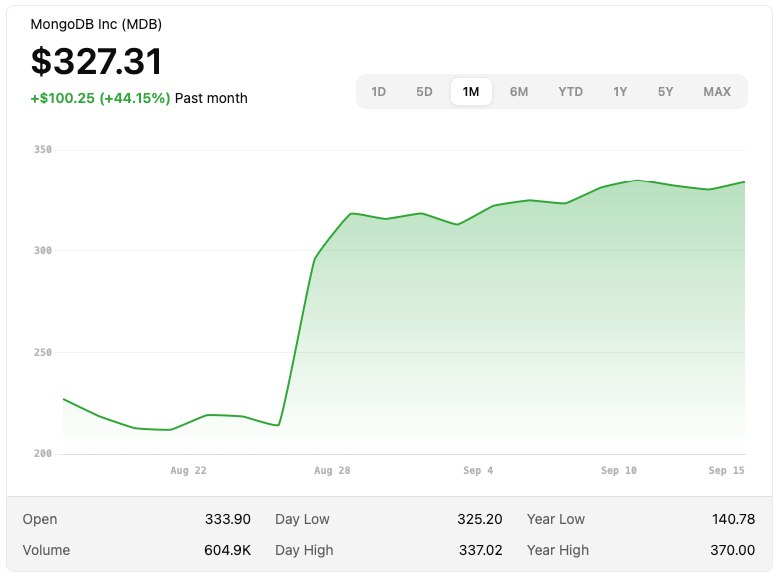

MDB

Name: MongoDB, Inc.

Symbol: MDB

Current Price: ~$327.31

Trade

Sell to Open: 1 MDB Oct 10, 2025 285/280 Put Vertical

Total Credit Received: $92.00

Credit per Contract: $92.00

Direction: Bullish (put credit spread)

Probability of Profit (PoP): 85.92%

Potential ROI:

Max Risk (Loss): $408.00

ROI: ($92.00 ÷ $408.00) × 100 ≈ 22.5%

Trade Explained in Simple English:

You are selling the 285-strike put and buying the 280-strike put, both expiring on October 10, 2025, forming a bullish put vertical spread. You receive $92 upfront for entering this trade. Your break-even point is approximately $284.08 (that’s the short put strike minus the credit per share). If MDB stays above this level by expiration, both options expire worthless and you keep the credit. Your upside is limited to that $92, and your maximum loss (if the stock falls below the long put strike of 280) is capped at $408.

Wall Street Highlights:

News Beyond the Numbers

Oracle shares rose sharply after reports that the company is part of a consortium that may enable TikTok to continue operating in the U.S. under a framework agreement between Beijing and Washington.

https://www.reuters.com/business/sp-500-nasdaq-set-higher-open-rate-cut-hopes-markets-sift-through-retail-data-2025-09-16/Dave & Buster's stock plunged over 17% in premarket trading following a disappointing earnings report with adjusted EPS below expectations and same-store sales decline.

https://www.investopedia.com/5-things-to-know-before-the-stock-market-opens-september-16-2025-11810739Wall Street is bracing for potential volatility ahead of a Supreme Court ruling on the constitutionality of tariffs, which could impact Corporate America's fiscal outlook.

https://www.reuters.com/world/us/wall-street-corporate-america-brace-more-tariff-turmoil-2025-09-16/Hedging activity shows a crowded trade with investors long on Wall Street equities while shorting the US dollar, reflecting changing global investor strategies.

https://www.reuters.com/markets/funds/hedging-surge-reflects-crowded-trade-long-wall-street-short-us-dollar-2025-09-16/President Donald Trump's renewed call to reduce the frequency of corporate earnings reports to twice a year could shake up Wall Street's trading business dynamics.

https://www.morningstar.com/news/marketwatch/2025091631/trump-revives-call-to-ditch-quarterly-earnings-reports-what-comes-nextOracle is spearheading an effort to buy TikTok's U.S. operations as negotiations make progress toward a trade framework between the U.S. and China.

https://247wallst.com/investing/2025/09/16/stock-market-live-september-16-good-tiktok-news-boosts-oracle-and-the-whole-sp-500-voo/Wall Street veterans signal that the hurdles for another 10% gain in the S&P 500 remain low due to ongoing optimism among investors.

https://www.morningstar.com/news/marketwatch/2025091638/the-hurdles-are-low-for-another-10-gain-for-the-sp-500-says-this-wall-street-veteranTrump's proposal to end quarterly earnings reports faces scrutiny but has about a 60% chance of SEC consideration, potentially changing corporate financial disclosure.

https://finance.yahoo.com/news/wall-street-raises-alarm-trump-204336897.htmlFinancial and housing sector stocks showed weakness while some firms benefited from upgrades and dealmaking amid shifting regulatory and economic conditions.

https://finimize.com/content/wall-street-sends-mixed-signals-as-key-sectors-slipWall Street prepares for further disruptions from tariffs as the Supreme Court's imminent decision could affect corporate strategies and market stability.

https://moderndiplomacy.eu/2025/09/16/wall-street-and-u-s-corporations-prepare-for-further-tariff-disruptions/