Here’s what’s happening in the stock market today:

The stock market is relatively calm today, with U.S. futures and major indices trading mostly flat as investors await the Federal Reserve's interest rate decision expected to signal the first rate cut of 2025. 📉💹 Most global equity markets show steady movement, while select stocks are making notable premarket advances. 💸📊

Major Indices Performance 📈

S&P 500 is essentially flat, near record highs. 📊

Dow Jones Industrial Average is up slightly by about 0.4%. 🏦

Nasdaq Composite is slightly down by approximately 0.1%, showing muted tech stock action. 🖥️

Market Movers 🚀

Premarket gainers include New Fortress Energy, Presidio Property Trust, and SciSparc Ltd with strong percentage jumps. 💥

Earnings reports from key companies like General Mills and Manchester United are anticipated today, adding some focus for investors. 📅

Key Events Driving the Market 🗞️

The Federal Reserve is widely expected to announce a 25 basis point rate cut, signaling potential monetary easing. This is expected at 2:00 p.m. ET and is seen as a major market catalyst. 🔔

Investors are watching Fed Chair Jerome Powell’s comments closely for guidance on future rate cuts and economic outlook. 📉

Economic data on housing starts and building permits is also due out today but getting less attention than the Fed decision. 🏘️

Investor Sentiment 👀

The sentiment is cautious, with subdued trading volumes as market participants await Fed clarity. 🐂📉

Global markets show mostly steady or mixed action amid the U.S. wait-and-see mode. Asian markets have been mixed recently. 🌍

This cautious tone comes before what many expect to be a key market moment with the Fed’s announcement potentially reshaping investor expectations for the rest of the year. 📊🚦

TRADE OF THE DAY:

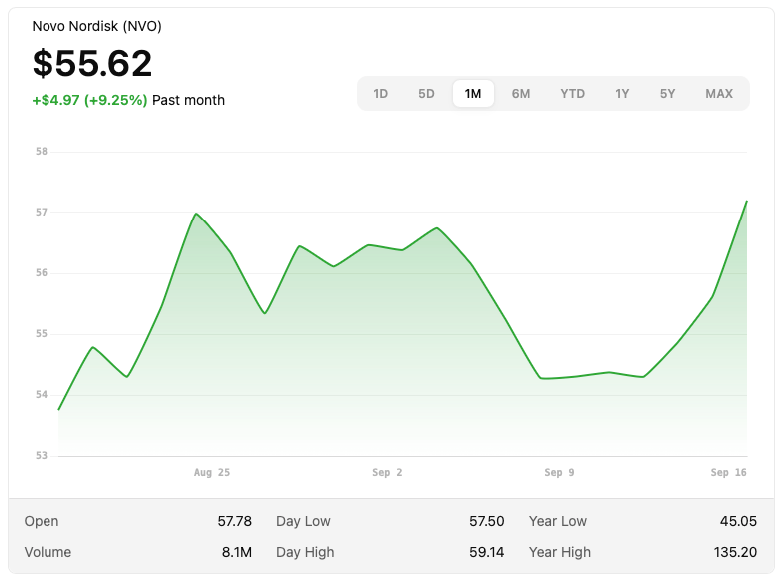

NVO

Name: Novo Nordisk A/S ADR

Symbol: NVO

Current Price: Approximately $58.72

Trade

Sell to Open: 1 NVO Oct 10, 2025 64/68 Call Vertical (Bear Call Spread)

Total Credit Received: $48.00

Credit per Contract: $48.00

Direction: Bearish (expects NVO to stay below break-even / short strike region)

Probability of Profit (PoP): 82.91% (as provided)

Potential ROI:

Max Risk (Loss): $352.00

ROI: ($48.00 ÷ $352.00) × 100 ≈ 13.6%

Trade Explained in Simple English:

You sold a vertical call spread on NVO, meaning you sold the 64 call and bought the 68 call, both expiring October 10, 2025. You collect $48 upfront. If NVO stays below about $64.48 by expiration, your sold calls expire worthless and you keep the full credit. Your maximum loss is capped at $352 if NVO goes above $68. This is a bearish strategy because you profit if the stock does not rise above the short strike.

Wall Street Highlights:

News Beyond the Numbers

New Fortress Energy surges 39% in premarket trading after securing a deal to supply liquefied gas to Puerto Rico.

https://www.reuters.com/sustainability/sustainable-finance-reporting/wall-st-set-muted-open-ahead-fed-policy-decision-nvidia-dips-2025-09-17/Elliott Management reveals it has acquired a stake of more than $2 billion in Workday, supporting the HR software company's leadership.

https://www.reuters.com/sustainability/sustainable-finance-reporting/wall-st-set-muted-open-ahead-fed-policy-decision-nvidia-dips-2025-09-17/JPMorgan appoints three insiders as global chairs of its investment banking division to capitalize on a resurgence in deal-making activity.

https://www.reuters.com/business/finance/jpmorgan-elevates-three-insiders-global-investment-banking-chairs-ma-revival-2025-09-09/Activist investor Elliott Management builds a $2 billion-plus stake in Workday while the software firm plans a $1.1 billion acquisition of a Swedish AI company.

https://finance.yahoo.com/news/live/stock-market-today-dow-rises-sp-500-and-nasdaq-steady-as-wall-street-braces-for-fed-decision-230515767.htmlCiti raises the price target on McDonald's to the highest on Wall Street, forecasting more than 25% upside potential.

https://www.cnbc.com/2025/09/17/citi-raises-price-target-on-mcdonalds-to-highest-on-wall-street-calls-for-more-than-25percent-upside.htmlGoldman Sachs gets a price target hike from Wells Fargo amid growing demand and strong profitability in capital markets.

https://www.cnbc.com/2025/09/16/new-wall-street-research-on-3-of-our-stocks-leans-into-the-reasons-we-own-each-of-them.htmlNvidia shares dip after reports that Chinese tech firms may halt purchases of its AI chips, reflecting supply chain tension.

https://www.reuters.com/sustainability/sustainable-finance-reporting/wall-st-set-muted-open-ahead-fed-policy-decision-nvidia-dips-2025-09-17/Raytheon Technologies sees analyst upgrades amid expectations of robust defense spending and contract growth.

https://www.reuters.com/business/finance/jpmorgan-elevates-three-insiders-global-investment-banking-chairs-ma-revival-2025-09-09/Workday shares gain after activist investor's support and plans to acquire an AI company to boost technology capabilities.

https://finance.yahoo.com/news/live/stock-market-today-dow-rises-sp-500-and-nasdaq-steady-as-wall-street-braces-for-fed-decision-230515767.htmlNew research from Wall Street analysts highlights strong potential in AI-related cloud service providers based in China.

https://www.wsj.com/print-edition/20250917/business-and-finance