Here’s what’s happening in the stock market today:

The stock market opened lower today with U.S. futures pointing to a decline following two days of losses, as investors continue to book profits especially in technology stocks. 📉💼 Major indices retreated on Wednesday and sentiment remains cautious amid concerns of stretched valuations and the pace of Federal Reserve interest rate cuts.

Major Indices Performance 📉

The S&P 500 fell about 0.28%, trading near 6619 points, marking a loss after recent gains. 📊

The Dow Jones Industrial Average dropped 0.4%, with mixed performance among its components. 🏦

The Nasdaq Composite slipped 0.3%, weighed down by tech giants' underperformance. 🖥️

Market Movers 🚀

Technology stocks continue to face profit-taking pressure, especially among AI-focused firms. 🤖

Oracle and Nvidia stocks pulled back ahead of key earnings reports. 📉

Energy sector showed some strength with a modest rise in energy ETFs. ⚡

Key Events Driving the Market 🗞️

Investors await important economic data releases and corporate earnings, including a spotlight on Costco’s quarterly results. 🛒

Federal Reserve Chairman Jerome Powell issued warnings about high equity valuations, adding to investor caution. 🔔

Inflation concerns and uncertainty about future interest rate cuts continue to weigh on market sentiment. 💹

Investor Sentiment 👀

The tone is cautious with subdued trading volume as investors hold back ahead of new market catalysts. Global markets show mixed signals while Wall Street seeks clearer guidance on the economic outlook and Fed policies. 🐂⏳

This environment reflects an ongoing balance between optimism about AI-driven growth and concerns over market valuations and policy shifts. 📊🔍

The Real Traders Aren't on CNBC

Your current options for finding stock trades:

Option 1: Spend 4 hours daily reading everything online

Option 2: Pay $500/month for paywalled newsletters and pray

Option 3: Get yesterday's news from mainstream financial media

All three keep you broke.

Here's where the actual edge lives:

Twitter traders sharing real setups (not TV personalities)

Crowdfunding opportunities before they go mainstream

IPO alerts with actual timing

Reddit communities spotting trends early

Crypto insider takes (not corporate PR)

The problem? You'd need to be terminally online to track it all.

Stocks & Income monitors every corner where real money gets made. We send you only the actionable opportunities. No fluff, no yesterday's headlines.

Five minutes daily. Walk away with stock insights you can actually act on every time.

Stocks & Income is for informational purposes only and is not intended to be used as investment advice. Do your own research.

TRADE OF THE DAY:

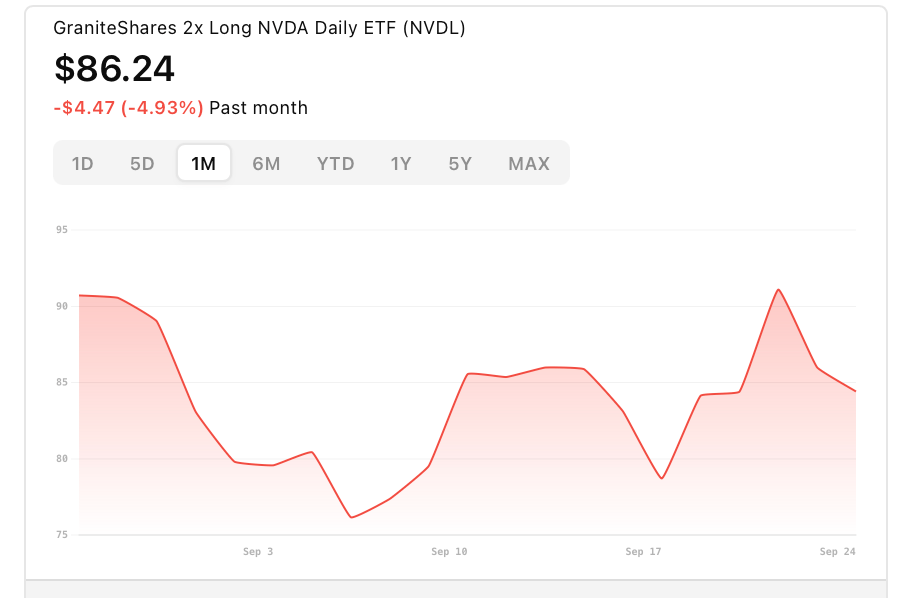

NVDL

Name: GraniteShares 2× Long NVDA Daily ETF

Symbol: NVDL

Current Price: ~ $86.24

Trade

Sell to Open: 1 NVDL Oct 24, 2025 65/60 Put Vertical

Total Credit Received: $65.00

Credit per Contract: $65.00

Direction: Bullish (expects NVDL to stay above the break-even)

Probability of Profit (PoP): 90.74%

Potential ROI

Max Risk (Loss): $435.00

ROI: ($65.00 ÷ $435.00) × 100 ≈ 14.9%

Trade Explained in Simple English:

You are initiating a bullish put vertical spread by selling the 65 put and buying the 60 put, both expiring October 24, 2025. You receive $65.00 in premium up front. The strategy will be profitable if NVDL closes above approximately $64.35 at expiration. Your maximum loss is capped at $435.00 (if NVDL falls below 60), and your maximum gain is $65.00.

Wall Street Highlights:

News Beyond the Numbers

Opendoor Technologies surged 7.53% after Jane Street disclosed a 59% stake in the real estate platform.

https://www.reuters.com/business/wall-street-futures-flat-caution-builds-ahead-inflation-data-2025-09-25/Lithium Americas shares jumped nearly 30% on reports the Trump administration seeks up to a 10% stake in the mining company.

https://www.reuters.com/business/wall-street-futures-flat-caution-builds-ahead-inflation-data-2025-09-25/Intel shares rose over 3% following news of talks with Apple about a potential investment to support the chipmaker’s turnaround.

https://finance.yahoo.com/news/live/stock-market-today-dow-sp-500-nasdaq-futures-fall-after-back-to-back-losses-jobless-claims-dip-234737751.htmlHertz announced a $250 million capital raise through exchangeable senior notes, boosting shares by 4% in premarket trading.

https://finance.yahoo.com/news/live/stock-market-today-dow-sp-500-nasdaq-futures-fall-after-back-to-back-losses-jobless-claims-dip-234737751.htmlCarMax shares fell 12% premarket after missing Q2 earnings expectations with weak revenue and cautious CEO comments.

https://finance.yahoo.com/news/live/stock-market-today-dow-sp-500-nasdaq-futures-fall-after-back-to-back-losses-jobless-claims-dip-234737751.htmlRedburn downgraded Oracle with a Sell rating and a price target implying a potential 42% drop, citing profit-taking risks.

https://finance.yahoo.com/news/live/stock-market-today-dow-sp-500-nasdaq-futures-fall-after-back-to-back-losses-jobless-claims-dip-234737751.htmlChinese tech stocks extended gains on strong investor enthusiasm for the nation’s AI developers.

https://finance.yahoo.com/news/live/stock-market-today-dow-sp-500-nasdaq-futures-fall-after-back-to-back-losses-jobless-claims-dip-234737751.htmlStarbucks is reducing workforce and closing locations as part of ongoing restructuring efforts to streamline operations.

https://www.investopedia.com/5-things-to-know-before-the-stock-market-opens-september-25-2025-11816837The White House has instructed federal agencies to prepare for workforce reductions if a government shutdown occurs next week.

https://finance.yahoo.com/news/live/stock-market-today-dow-sp-500-nasdaq-futures-fall-after-back-to-back-losses-jobless-claims-dip-234737751.htmlUS automakers anticipate saving $700 million monthly as the new US trade agreement takes effect, boosting industry cost outlook.

https://finance.yahoo.com/news/live/stock-market-today-dow-sp-500-nasdaq-futures-fall-after-back-to-back-losses-jobless-claims-dip-234737751.html

Disclaimer: The content provided by OptionPicks is for informational and educational purposes only and should not be construed as investment, financial, legal, or tax advice. We are not registered as a broker-dealer, investment adviser, or financial advisor with the SEC, FINRA, or any other regulatory authority. Options trading involves substantial risk and is not suitable for every investor. Past performance is not indicative of future results, and no representation is being made that any subscriber will or is likely to achieve profits or incur losses similar to those mentioned. You should consult with a licensed financial professional before making any investment decisions.