Here’s what’s happening in the stock market today:

The stock market is showing cautious modest gains today as investors continue to weigh the impact of the U.S. government shutdown, now in its tenth day, and ongoing uncertainties. 📈 Despite the deadlock in Washington, stock index futures for the S&P 500 and Nasdaq have inched up about 0.1%, while Dow futures gained roughly 48 points, signaling light optimism. Major indexes had pulled back from record highs earlier this week but remain on track for modest weekly gains overall.

Major Indices Performance 📊

S&P 500 and Nasdaq futures up around 0.1%, projecting weekly gains of 0.3% and 1.1% respectively.

Dow Jones futures up 48 points (~0.1%) but the index faces a weekly decline on the back of previous weakness.

Nvidia shares have climbed about 2.6% this week, supporting the Nasdaq and parts of the tech sector.

Market Movers 🚀

Nvidia sustained momentum with gains driven by optimism on computing demand.

Mixed earnings results from companies like Delta Air Lines and PepsiCo showing some consumer demand, though not enough to boost broad rallies.

Other key tech stocks show mixed performance amid AI-related positive sentiment.

Key Events Driving the Market 🗞️

The U.S. government shutdown continues with little progress in funding negotiations, creating an element of uncertainty.

Absence of government economic reports complicates market signals, leaving investors focused on corporate earnings and private data.

The Federal Reserve outlook remains a focal point amid talks of future rate cuts.

Commodity prices and inflation expectations are also influencing market sentiment.

Investor Sentiment 👀

Investor mood remains cautious but slightly optimistic, balancing recent strong earnings signals against political risks and economic uncertainties. Trading volumes are subdued as participants await further economic data and any resolution to the government funding impasse. 🐂⚖️

Your daily edge in private markets

Wondering what’s the latest with crypto treasury companies, Pre-IPO venture secondaries, private credit deals and real estate moves? Join 100,000+ private market investors who get smarter every day with Alternative Investing Report, the industry's leading source for investing in alternative assets.

In your inbox by 9 AM ET, AIR is chock full of the latest insights, analysis and trends that are driving alts. Readers get a weekly investment pick to consider from a notable investor, plus special offers to join top private market platforms and managers.

And the best part? It’s totally free forever.

TRADE OF THE DAY:

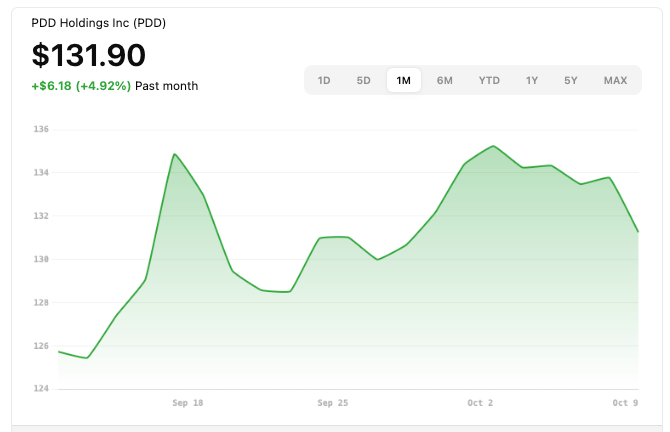

PDD

Name: PDD Holdings, Inc.

Symbol: PDD

Current Price: ~ $131.90

Trade

Sell to Open: 1 PDD Nov 7, 2025 120/115 Put Vertical

Total Credit Received: $45.00

Credit per Contract: $45.00 (for one contract covering 100 shares)

Direction: Bullish (expects PDD to stay above break-even level)

Probability of Profit (PoP): 85.01%

Potential ROI

Max Risk (Loss): $455.00

ROI: ($45 ÷ $455) × 100 ≈ 9.9%

Trade Explained in Simple English

You’re entering a put vertical spread by selling the 120 strike put and buying the 115 strike protective put, both expiring November 7, 2025. You receive $45 upfront. If PDD stays above about $119.55 (your break-even), both puts expire worthless and you keep the credit. Your maximum loss is capped at $455 if PDD falls below $115 at expiration. This is a bullish trade that benefits if the stock stays above your break-even price.

Wall Street Highlights:

News Beyond the Numbers

Levi Strauss shares dropped 9.6% despite posting better-than-expected quarterly profits, weighed down by lofty investor expectations after a 42% year-to-date gain. Read more.

Robinhood's stock surged 284% in the year leading up to September, driven by its role in cryptocurrency and sports betting trading, and was added to the S&P 500 last month. Read more.

Investors continue to benefit from a surge in capital investments in artificial intelligence infrastructure, with companies like Nvidia, Broadcom, Intel, Microsoft, Oracle, and Meta seeing gains. Read more.

Treasury yields slightly decreased following the recent $22 billion auction of 30-year bonds, highlighting continued investor demand for long-term government debt. Read more.

The ongoing U.S. government shutdown has delayed several key economic data releases that typically move markets, creating uncertainty among investors. Read more.

Disclaimer: The content provided by OptionPicks is for informational and educational purposes only and should not be construed as investment, financial, legal, or tax advice. We are not registered as a broker-dealer, investment adviser, or financial advisor with the SEC, FINRA, or any other regulatory authority. Options trading involves substantial risk and is not suitable for every investor. Past performance is not indicative of future results, and no representation is being made that any subscriber will or is likely to achieve profits or incur losses similar to those mentioned. You should consult with a licensed financial professional before making any investment decisions.