Here’s what’s happening in the stock market today:

The stock market is showing cautious weakness today amid renewed trade tensions between the U.S. and China. 📉 Major U.S. indexes are down around 1%, with the S&P 500 off about 1%, Nasdaq dropping 1.3%, and the Dow down roughly 0.8% early in the session. This follows a selloff driven by Beijing's announcement of new export controls on rare earth materials and bans on certain U.S. shipping firms, escalating fears around the trade conflict. 🏛️⚠️

Major Indices Performance 📊

S&P 500 is down approximately 1%, breaking a recent rally.

Dow Jones Industrial Average futures fell about 0.8%.

Nasdaq Composite dropped about 1.3%, weighed by tech stock volatility.

Market Movers 🚀

Financial stocks like JPMorgan, Goldman Sachs, and Citigroup are in focus with earnings season underway, some beating expectations.

Broadcom shares surged nearly 10% yesterday on an AI chip partnership news but dipped 3% in premarket today.

Johnson & Johnson reported solid Q3 earnings but shares showed little movement.

Key Events Driving the Market 🗞️

China’s new trade restrictions increase geopolitical uncertainty, impacting global trade and supply chains.

U.S. Treasury Secretary Scott Bessent stated China would suffer the most if it doesn't comply with U.S. demands, intensifying trade rhetoric.

Investors await key economic data and further trade talks at the upcoming APEC summit where President Trump and President Xi Jinping are expected to meet.

Concerns over a U.S. government shutdown continue, adding to market jitters.

Investor Sentiment 👀

Overall, investors are cautious, balancing optimism from strong recent earnings and anticipation of trade negotiations against heightened volatility from geopolitical risks and market uncertainties. Safe-haven assets like gold have surged to record highs but stocks are retreating, reflecting risk-off sentiment. 🛡️📉

The market tone is one of cautious watchfulness with volatile moves expected as trade developments and earnings reports unfold. Traders remain alert to both geopolitical flashpoints and fresh economic signals.

A Private Circle for High-Net-Worth Peers

Long Angle is a private, vetted community for HNW entrepreneurs and executives. No membership fees. What’s inside:

Self-made professionals, 30-55 years old, $5M-$100M net worth

Confidential discussions, peer advisory groups, live meetups

Institutional-grade investments, $100M+ invested annually

TRADE OF THE DAY:

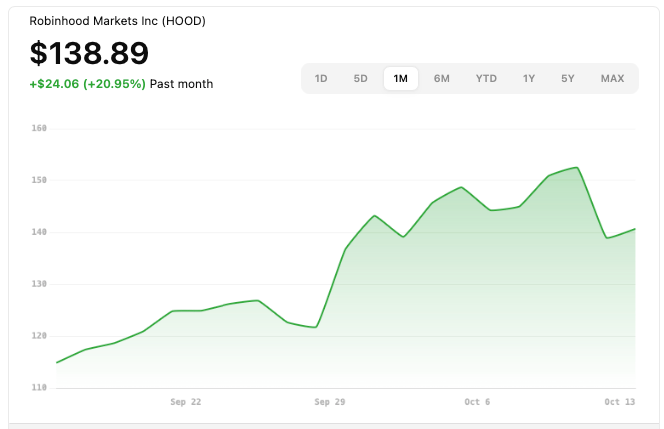

HOOD

Name: Robinhood Markets, Inc.

Symbol: HOOD

Current Price: ~$138.89

Trade

Sell to Open: 1 HOOD Oct 31, 2025 120/115 Put Vertical

Total Credit Received: $61.00

Credit per Contract: $61.00 (for one contract covering 100 shares)

Direction: Bullish (expects HOOD to stay above the break-even level)

Probability of Profit (PoP): 84.67%

Potential ROI:

Max Risk (Loss): $439.00

ROI: ($61 ÷ $439) × 100 ≈ 13.9%

Trade Explained in Simple English:

You’re selling the 120-strike put and buying the 115-strike put, both expiring October 31, 2025. You receive $61 upfront. If HOOD stays above about $119.39 (your break-even), both puts expire worthless and you keep the full credit. Your maximum loss is capped at $439 if HOOD falls below $115 at expiration. This is a bullish trade, profiting if the stock remains above the break-even level.

Wall Street Highlights:

News Beyond the Numbers

Goldman Sachs announced a $665 million acquisition of Industry Ventures, a venture capital firm managing $7 billion, to expand its investment capabilities in fast-growing sectors. Read more.

Wells Fargo reported third-quarter earnings beating expectations, driven by strong interest income, with EPS of $1.66 and revenue of $21.44 billion. Read more.

JPMorgan Chase posted robust Q3 results surpassing forecasts, thanks to strong trading and investment banking revenues, with earnings per share of $5.07. Read more.

U.S. rare earth mining companies rallied in premarket trading, with Critical Metals up 35%, on expectations that the U.S. will increase efforts to reduce dependence on China. Read more.

Broadcom's shares fell 1.9% after announcing a partnership with OpenAI to develop the AI startup's first in-house processors, following a prior 10% surge. Read more.

Disclaimer: The content provided by OptionPicks is for informational and educational purposes only and should not be construed as investment, financial, legal, or tax advice. We are not registered as a broker-dealer, investment adviser, or financial advisor with the SEC, FINRA, or any other regulatory authority. Options trading involves substantial risk and is not suitable for every investor. Past performance is not indicative of future results, and no representation is being made that any subscriber will or is likely to achieve profits or incur losses similar to those mentioned. You should consult with a licensed financial professional before making any investment decisions.