Here’s what’s happening in the stock market today:

The stock market is exhibiting strong momentum today, with major U.S. indexes hitting record highs driven by optimism over solid corporate earnings, cooling inflation, and the Federal Reserve's potential interest rate cut. 📈✨ The S&P 500 surged above 6,800 for the first time in history, supported by robust performances from tech giants and healthcare companies. Investors remain upbeat amid hopes for a truce between the U.S. and China on trade tensions. 🌐🤝

Major Indices Performance 📊

S&P 500 rose about 1.2%, closing above the crucial 6,800 technical barrier.

Dow Jones Industrial Average advanced roughly 0.6%, continuing its recent record-setting streak.

Nasdaq Composite gained around 0.5%, buoyed by tech sector earnings and AI chip innovations.

Market Movers 🚀

Qualcomm shares jumped 11.1% after unveiling a new AI chip designed for data centers, intensifying competition with Nvidia and AMD.

UnitedHealth Group shares rose 4% following a third-quarter earnings beat and raised 2025 profit outlook.

UPS stock soared after surpassing profit expectations amid aggressive cost-cutting and workforce reductions.

Amazon shares edged higher despite announcing plans to cut approximately 14,000 corporate jobs as it integrates more AI.

Key Events Driving the Market 🗞️

Anticipation of a Federal Reserve interest rate cut on Wednesday is buoying investor sentiment.

Strong earnings reports from major companies including UnitedHealth, Qualcomm, and UPS underpin confidence.

Cooling inflation metrics and easing global trade tensions are fostering risk appetite.

AI and technology sector innovation remain focal points, with Nvidia CEO Jensen Huang scheduled to speak at a major AI conference today.

Investor Sentiment 👀

Investor mood is optimistic with a cautiously confident tone as markets reach historic highs. There is strong appetite for tech and healthcare stocks, balanced by some watchfulness ahead of the Fed meeting. Overall, the outlook favors continued gains amid supportive earnings and macroeconomic signals. 🐂💹

Institutional-Grade Opportunities for HNW Investors

Long Angle is a private, vetted community connecting high-net-worth entrepreneurs and executives with institutional-grade alternative investments. No membership fees.

Access top-tier opportunities across private equity, credit, search funds, litigation finance, energy, hedge funds, and secondaries. Leverage collective expertise and scale for better terms.

Invest alongside pensions, endowments, and family offices. With $100M+ invested annually, secure preferential terms unavailable to individual investors.

TRADE OF THE DAY:

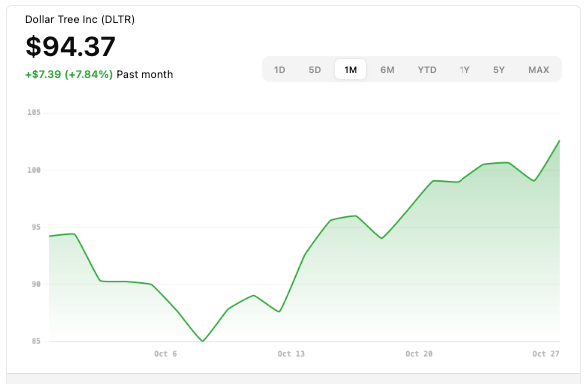

DLTR

Name: Dollar Tree, Inc.

Symbol: DLTR

Current Price: ~$101.60

Trade

Sell to Open: 1 DLTR Nov 21, 2025 92/88 Put Vertical

Total Credit Received: $56.00

Credit per Contract: $56.00 (for one contract covering 100 shares)

Direction: Bullish (expects DLTR to stay above break-even level)

Probability of Profit (PoP): 84.29%

Potential ROI:

Max Risk (Loss): $344.00

ROI: ($56 ÷ $344) × 100 ≈ 16.3%

Trade Explained in Simple English:

You’re selling one put vertical spread in DLTR—selling the $92 strike put and buying the $88 strike put, both expiring November 21, 2025. You receive $56 upfront as credit. The trade profits if DLTR stays above about $91.44 (your break-even) by expiration. Your maximum loss is limited to $344 if DLTR falls below $88, and your maximum gain is the $56 credit if the stock stays above the short strike. This is a bullish position expecting DLTR to remain above the $92 level.

Wall Street Highlights:

News Beyond the Numbers

PayPal shares surged 12.7% after announcing a partnership with OpenAI, enabling ChatGPT users to make instant purchases through the platform. Read more.

Microsoft and OpenAI finalized a deal allowing OpenAI to restructure into a public benefit corporation, valuing OpenAI at $500 billion and paving the way for its public listing. Read more.

Apple and Microsoft crossed the $4 trillion market cap milestone, driven by strong recent performance including promising sales of Apple's iPhone 17 models. Read more.

Royal Caribbean Group stock fell 7.6% following a disappointing profit outlook for the upcoming quarter, impacting cruise industry sentiment. Read more.

NextEra Energy gained 2.1% after reaching a nuclear energy agreement with Google, signaling advances in clean energy collaborations. Read more.

Disclaimer: The content provided by OptionPicks is for informational and educational purposes only and should not be construed as investment, financial, legal, or tax advice. We are not registered as a broker-dealer, investment adviser, or financial advisor with the SEC, FINRA, or any other regulatory authority. Options trading involves substantial risk and is not suitable for every investor. Past performance is not indicative of future results, and no representation is being made that any subscriber will or is likely to achieve profits or incur losses similar to those mentioned. You should consult with a licensed financial professional before making any investment decisions.