Here’s what’s happening in the stock market today:

The stock market is relatively calm today, with U.S. futures and major indices mostly flat as investors await Nvidia's highly anticipated earnings report later in the session. 📈💹🚀 Most global equity markets are steady, while select stocks are making notable premarket moves. 💸📊

Major Indices Performance 📈

S&P 500 is up slightly, trading near record highs. 📊

Dow Jones Industrial Average is essentially flat, showing minimal movement. 🏦

Nasdaq and tech stocks have a muted performance with slight fluctuations. 🖥️

Market Movers 🚀

Certain stocks are making strong premarket moves:

Nvidia is seeing modest gains ahead of its earnings report. 🤖

Canada Goose and Cracker Barrel stocks are rising due to company-specific news. 💼

MongoDB surged significantly after raising its annual profit forecast. 💰

Key Events Driving the Market 🗞️

Investors are closely watching Nvidia’s earnings, which could be a major catalyst for the tech sector and the overall market. 🚦

U.S. tariffs on imports from India have increased, impacting certain sectors. 🌏

Federal Reserve news continues to contribute to market uncertainty. 🔔

Investor Sentiment 👀

The overall tone is cautious, with trading volume subdued and most market participants waiting for more clarity from corporate earnings, especially from Nvidia. Global sentiment is boosted by healthy gains in some Asian markets, but U.S. traders remain in a holding pattern. 🐂📈

7 Ways to Take Control of Your Legacy

Planning your estate might not sound like the most exciting thing on your to-do list, but trust us, it’s worth it. And with The Investor’s Guide to Estate Planning, preparing isn’t as daunting as it may seem.

Inside, you’ll find {straightforward advice} on tackling key documents to clearly spell out your wishes.

Plus, there’s help for having those all-important family conversations about your financial legacy to make sure everyone’s on the same page (and avoid negative future surprises).

Why leave things to chance when you can take control? Explore ways to start, review or refine your estate plan today with The Investor’s Guide to Estate Planning.

TRADE OF THE DAY:

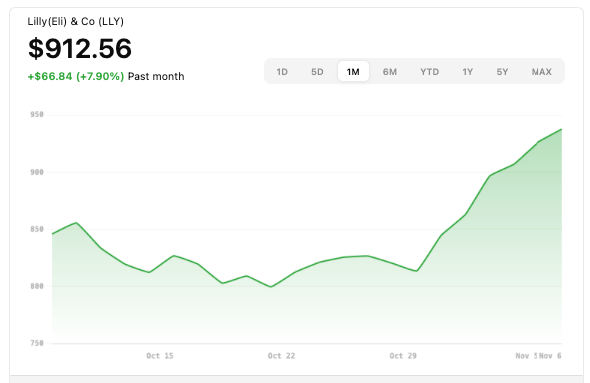

LLY

Name: Eli Lilly and Company

Symbol: LLY

Current Price: Approximately $912.56

Trade

Sell to Open: 1 LLY Nov 28 2025 835/830 Put Vertical

Total Credit Received: $45.00

Credit per Contract: $45.00 (1 contract = 100 shares)

Direction: Bullish (expects stock to stay above break-even and avoid going below short put)

Probability of Profit (PoP): 84.98%

Potential ROI:

Max Risk (Loss): $455.00

ROI: ($45.00 ÷ $455.00) × 100 ≈ 9.9%

Trade Explained in Simple English:

You’re selling the 835 strike put and buying the 830 strike put for expiration on November 28, 2025, which gives you a net credit of $45 upfront. If LLY stays above about $834.55 by expiration (your break-even), both options expire worthless and you keep the credit. Your maximum loss is capped at $455 if LLY closes at or below 830 at expiration. Because you’ve sold the higher strike put, this is a bullish trade that benefits if the stock remains strong.

Wall Street Highlights:

News Beyond the Numbers

Tesla shareholders approved Elon Musk’s record $1 trillion compensation package in a decisive vote, marking a milestone for executive pay in tech. Read more.

Take-Two Interactive shares tumbled over 4% after the company postponed the release of “Grand Theft Auto VI” to November 2026, disappointing fans and investors. Read more.

Datadog surged over 23% after delivering strong third-quarter growth and earning multiple analyst upgrades for its cloud-monitoring technology. Read more.

Tailwind 2.0 Acquisition Corp. successfully priced its IPO at $10 per unit, aiming to raise $150 million as it begins trading on Nasdaq today. Read more.

Expedia Group jumped following its announcement of a raised annual revenue growth forecast, reinforcing optimism in the travel sector. Read more.

Disclaimer: The content provided by OptionPicks is for informational and educational purposes only and should not be construed as investment, financial, legal, or tax advice. We are not registered as a broker-dealer, investment adviser, or financial advisor with the SEC, FINRA, or any other regulatory authority. Options trading involves substantial risk and is not suitable for every investor. Past performance is not indicative of future results, and no representation is being made that any subscriber will or is likely to achieve profits or incur losses similar to those mentioned. You should consult with a licensed financial professional before making any investment decisions.