Here’s what’s happening in the stock market today:

The stock market is showing optimism today as signs of progress emerge toward ending the longest U.S. government shutdown in history. 📈 The S&P 500, Nasdaq 100, and Dow Jones Industrial Average futures are all rising, fueled by growing bipartisan momentum in the Senate to advance a funding bill. Tech stocks, led by Nvidia, are seeing significant gains, helping to lift the broader market.

Major Indices Performance 📊

S&P 500 futures are up about 0.9%, with the index rebounding from last week's losses.

Nasdaq 100 futures have gained around 1.5%, recovering from its worst week since April, driven by robust tech stock gains including Nvidia.

Dow Jones futures rose approximately 0.4%, reflecting broader market enthusiasm.

Market Movers 🚀

Nvidia stands out with premarket gains of more than 3%.

Other AI and tech-related stocks are also rallying, contributing to the Nasdaq's recovery.

Some sectors focused on quality growth and AI productivity are attracting renewed investor interest.

Key Events Driving the Market 🗞️

The U.S. Senate advanced a procedural vote to move forward on a funding bill aimed at ending the government shutdown, increasing investor hope for a resolution within days. The final vote in the Senate and House approval remain pending. 🏛️

The shutdown has stalled economic data releases, contributing to market uncertainty. Reopening would restore key data flow on employment and inflation.

Treasury yields have risen slightly, with the 10-year note yield around 4.13%, as bonds sold off amid improved risk appetite.

Investors remain cautious about high valuations in the AI sector and the economic impact of tariffs and job market pressures.

Investor Sentiment 👀

Overall, the mood appears cautiously optimistic with markets rallying on hopes for government reopening, while trading volumes remain measured as investors weigh the lingering risks. The blend of relief and uncertainty is shaping a tentative recovery following last week’s tech selloff.

This dynamic presents a market environment balancing political progress, reopening optimism, and ongoing macroeconomic concerns. 🐂⚖️

Crash Expert: “This Looks Like 1929” → 70,000 Hedging Here

Mark Spitznagel, who made $1B in a single day during the 2015 flash crash, warns markets are mimicking 1929. Yeah, just another oracle spouting gloom and doom, right?

Vanguard and Goldman Sachs forecast just 5% and 3% annual S&P returns respectively for the next decade (2024-2034).

Bonds? Not much better.

Enough warning signals—what’s something investors can actually do to diversify this week?

Almost no one knows this, but postwar and contemporary art appreciated 11.2% annually with near-zero correlation to equities from 1995–2024, according to Masterworks Data.

And sure… billionaires like Bezos and Gates can make headlines at auction, but what about the rest of us?

Masterworks makes it possible to invest in legendary artworks by Banksy, Basquiat, Picasso, and more – without spending millions.

23 exits. Net annualized returns like 17.6%, 17.8%, and 21.5%. $1.2 billion invested.

Shares in new offerings can sell quickly but…

*Past performance is not indicative of future returns. Important Reg A disclosures: masterworks.com/cd.

TRADE OF THE DAY:

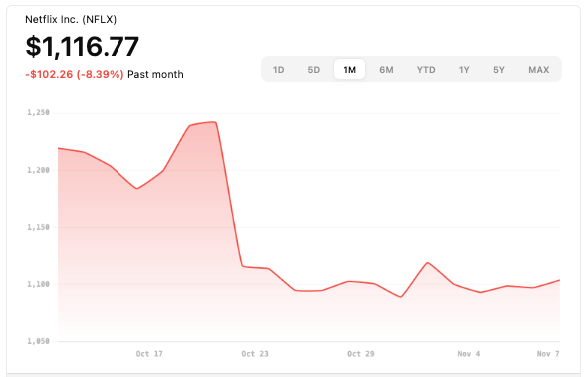

NFLX

Name: Netflix, Inc.

Symbol: NFLX

Current Price: ~$1,118.50

Trade

Sell to Open: 1 NFLX Nov 28, 2025 1195/1200 Call Vertical

Total Credit Received: $52.00

Credit per Contract: $52.00 (for one contract covering 100 shares)

Direction: Bearish (expects NFLX to stay below break-even)

Probability of Profit (PoP): 85.92%

Potential ROI:

Max Risk (Loss): $448.00

ROI: ($52.00 ÷ $448.00) × 100 ≈ 11.6%

Trade Explained in Simple English:

You are selling the 1195 strike call and buying the 1200 strike call of NFLX expiring November 28, 2025, creating a bearish call spread. You collect $52 upfront. The trade profits if NFLX stays below about $1,195.42 at expiration. Your maximum loss is limited to $448 if NFLX rises above $1,200, and your maximum reward is the $52 credit received. This trade benefits if NFLX remains under the short strike.

Wall Street Highlights:

News Beyond the Numbers

Dole reported slightly missed earnings but stronger sales with management expressing confidence in momentum, leading to an 8% rise in its stock price. Read more.

Barrick Mining posted earnings below expectations but still saw a 6% boost in its stock following its quarterly report. Read more.

American Airlines rebounded as pressures eased from flight reductions at major airports caused by the government shutdown. Read more.

Citi raised its price target for Nvidia to $220 ahead of earnings, projecting stronger sales than analysts expected. Read more.

U.S. chipmaker Micron saw a significant early trading jump of over 7%, reflecting investor optimism amid ongoing earnings reports. Read more.

Disclaimer: The content provided by OptionPicks is for informational and educational purposes only and should not be construed as investment, financial, legal, or tax advice. We are not registered as a broker-dealer, investment adviser, or financial advisor with the SEC, FINRA, or any other regulatory authority. Options trading involves substantial risk and is not suitable for every investor. Past performance is not indicative of future results, and no representation is being made that any subscriber will or is likely to achieve profits or incur losses similar to those mentioned. You should consult with a licensed financial professional before making any investment decisions.