Here’s what’s happening in the stock market today:

The stock market today shows cautious mixed moves as investors digested multiple influences with a focus on upcoming big earnings and economic data. S&P 500 futures fell about 0.2%, Dow Jones Industrial Average futures dropped roughly 0.2%, and Nasdaq-100 futures declined around 0.3% early in the day, reflecting early weakness and some volatility. The market is cautious ahead of key earnings, notably Nvidia's results, and closely watching economic indicators expected this week.

Major Indices Performance 📊

S&P 500 futures are down approximately 0.2%, signaling some early market softness.

Dow Jones futures dropped about 0.2%, reflecting modest retracement after recent gains.

Nasdaq futures declined close to 0.3%, showing tech sector volatility.

Market Movers 🚀

Tech stocks, especially those related to AI and Nvidia, are in focus with Nvidia's earnings looming.

Defense and blue-chip stocks showed mixed performances, with some modest rebounds but overall cautious tone.

Banks and rate-sensitive financials have seen some rotation away from their recent strength.

Key Events Driving the Market 🗞️

Investors are awaiting critical earnings reports, with Nvidia’s earnings expected to set the tone for tech sector momentum.

Economic data this week, including flash PMI and Fed minutes, is influencing sentiment amid debates on future rate cuts.

Treasury yields remain elevated with the 10-year near one-month highs around 4.15%, contributing to cautious sentiment.

Fed policy uncertainty persists as markets weigh strong economic growth alongside sticky inflation.

Investor Sentiment 👀

Overall, trading volumes are subdued with investors balancing optimism from recent gains against caution about inflation, Fed policy, and corporate earnings risks. Volatility remains elevated but not extreme, suggesting a market in a wait-and-see mode before the week’s major earnings and economic reports unfold. This mix of optimism and caution is shaping a nuanced but cautious market mood today.

This summary reflects the stock market environment as of November 17, 2025.

The Year-End Moves No One’s Watching

Markets don’t wait — and year-end waits even less.

In the final stretch, money rotates, funds window-dress, tax-loss selling meets bottom-fishing, and “Santa Rally” chatter turns into real tape. Most people notice after the move.

Elite Trade Club is your morning shortcut: a curated selection of the setups that still matter this year — the headlines that move stocks, catalysts on deck, and where smart money is positioning before New Year’s. One read. Five minutes. Actionable clarity.

If you want to start 2026 from a stronger spot, finish 2025 prepared. Join 200K+ traders who open our premarket briefing, place their plan, and let the open come to them.

By joining, you’ll receive Elite Trade Club emails and select partner insights. See Privacy Policy.

TRADE OF THE DAY:

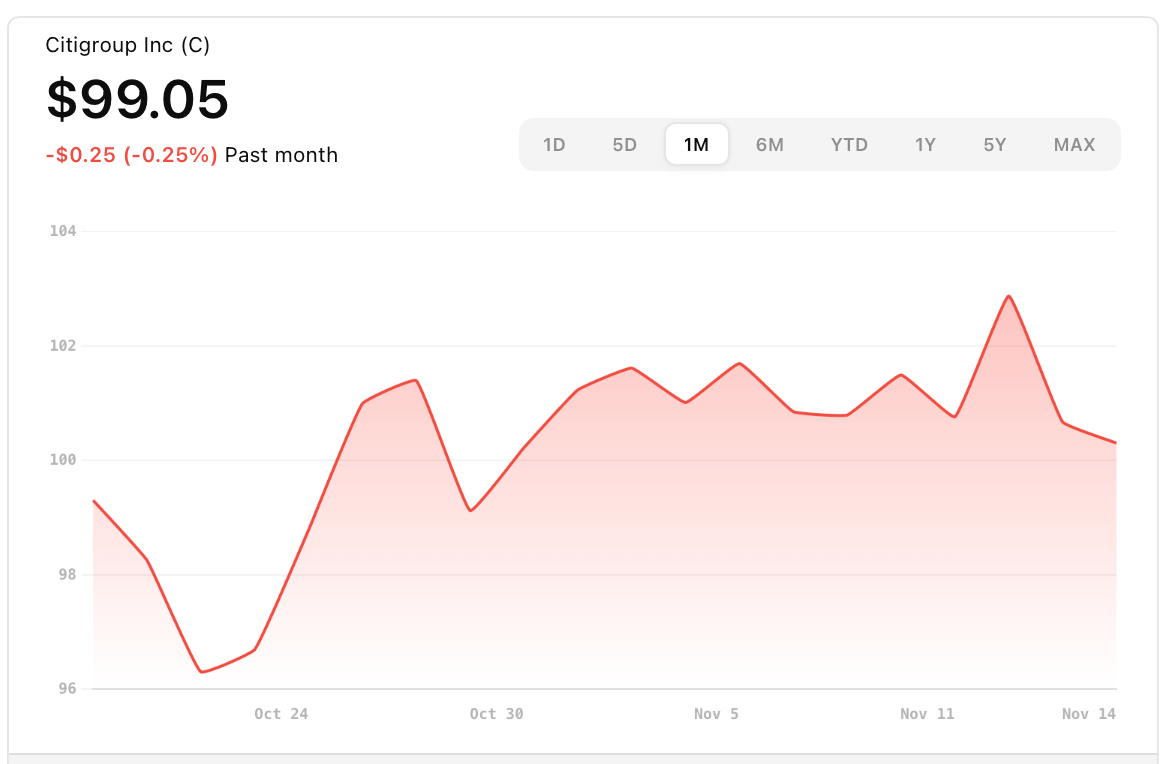

C

Name: Citigroup Inc.

Symbol: C

Current Price: ~$99.05

Trade

Sell to Open: 1 C Nov 28 2025 94/89 Put Vertical

Total Credit Received: $40.00

Credit per Contract: $40.00

Direction: Bullish

Probability of Profit (PoP): 84.05%

Potential ROI:

Max Risk (Loss): $460.00

ROI: ($40.00 ÷ $460.00) × 100 ≈ 8.7%

Trade Explained in Simple English:

You’re selling the 94 strike put and buying the 89 strike put that both expire on November 28, 2025, collecting a total of $40 up front. The trade makes money if Citigroup stays above the break-even price of about $93.60. Your maximum loss is capped at $460 if the stock falls below $89 at expiration, while your maximum profit is the $40 credit. This setup is bullish because it benefits from the stock remaining above the short strike.

Wall Street Highlights:

News Beyond the Numbers

Nvidia is set to release its highly anticipated earnings this week, with expectations of strong revenue growth fueled by AI infrastructure demand and data center hardware sales.

Read more.Warren Buffett boosted his stake in Google, driving notable gains in the tech giant’s stock ahead of key industry earnings reports.

Read more.Energy shares climbed following rising crude oil prices amid geopolitical tensions, benefiting companies in the oil services and equipment sectors.

Read more.Warner Brothers Discovery's shares jumped over 4% after the company amended its CEO's employment agreement during a strategic business review.

Read more.Baker Hughes stock rose by 2.6%, supported by favorable energy sector trends and positive outlooks on upcoming earnings reports.

Read more.

Disclaimer: The content provided by OptionPicks is for informational and educational purposes only and should not be construed as investment, financial, legal, or tax advice. We are not registered as a broker-dealer, investment adviser, or financial advisor with the SEC, FINRA, or any other regulatory authority. Options trading involves substantial risk and is not suitable for every investor. Past performance is not indicative of future results, and no representation is being made that any subscriber will or is likely to achieve profits or incur losses similar to those mentioned. You should consult with a licensed financial professional before making any investment decisions.