Here’s what’s happening in the stock market today:

The stock market is showing optimism today as traders enter a shortened trading week ahead of Thanksgiving, driven by hopes of a Federal Reserve interest rate cut in December. 📈 Futures for the S&P 500, Dow Jones Industrial Average, and Nasdaq are all up, signaling a rebound from recent November losses, especially in technology stocks like Nvidia . This sentiment is supported by positive comments from the New York Fed president about easing monetary policy due to labor market weakness.

Major Indices Performance 📊

S&P 500 futures are up around 0.5%, helping push the SPDR S&P 500 ETF higher.

Dow Jones futures have risen about 82 points (0.2%), with 25 of 30 components showing gains.

Nasdaq 100 futures are up about 0.8%, fueled by notable strength in tech stocks.

Overall, the Nasdaq Composite has gained about 0.9%, marking a technical-led recovery.

Market Movers 🚀

Nvidia continues to be a standout stock, backed by its strong data center business.

Other tech names also contributed to the Nasdaq’s upward momentum.

Some stocks with big gains recently include Newegg Commerce and Azenta Inc., showing strong percentage increases in the market.

Key Events Driving the Market 🗞️

Federal Reserve officials signal a high likelihood (around 75%) of a rate cut in December, aiming to address rising unemployment and a weakening labor market.

The unemployment rate recently hit a four-year high, reinforcing calls for monetary easing.

Despite these optimistic moves, November has been a challenging month for the market, with major indexes down several percentage points, mainly due to reassessments of high-valued AI-linked stocks.

Investor Sentiment 👀

Investor mood is cautiously optimistic with a preference for technology stocks as a driver for gains amidst economic uncertainty and inflation concerns. Trading volumes may remain subdued in this holiday-shortened week, but the outlook is hopeful for a recovery from recent market declines. 🐂⚖️

Invest right from your couch

Have you always been kind of interested in investing but found it too intimidating (or just plain boring)? Yeah, we get it. Luckily, today’s brokers are a little less Wall Street and much more accessible. Online stockbrokers provide a much more user-friendly experience to buy and sell stocks—right from your couch. Money.com put together a list of the Best Online Stock Brokers to help you open your first account. Check it out!

TRADE OF THE DAY:

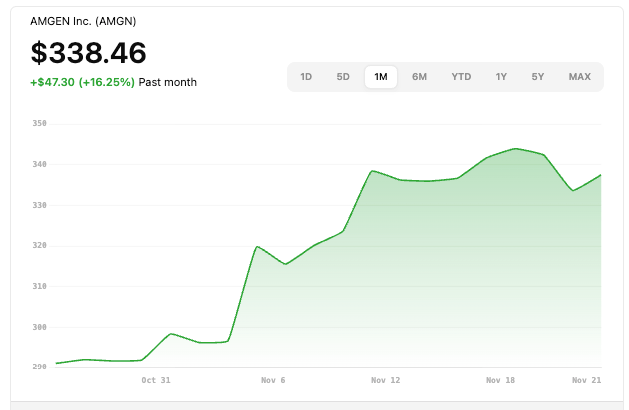

AMGN

Name: Amgen Inc.

Symbol: AMGN

Current Price: ~$338.46

Trade

Sell to Open: 1 AMGN Dec 26, 2025 315/310 Put Vertical

Total Credit Received: $86.00

Credit per Contract: $86.00

Direction: Bullish

Probability of Profit (PoP): 83.31%

Potential ROI:

Max Risk (Loss): $414.00

ROI: ($86 ÷ $414) × 100 ≈ 20.8%

Trade Explained in Simple English:

You are selling the 315 put and buying the 310 put for December 26, 2025, receiving $86 upfront. Your break-even price is roughly $314.14, which means you’ll make money if AMGN closes above that by expiration. If AMGN stays above 315, you keep the full credit, but your worst-case loss is capped at $414 if it falls below 310.

Wall Street Highlights:

News Beyond the Numbers

BHP has ended its pursuit of Anglo American after the latter rejected its proposal, paving the way for Anglo's merger offer with Canada's Teck Resources. Read more.

New disclosures from Jeffrey Epstein's emails have led to scrutiny of several high-profile associates, impacting business and political circles, with some beneficiaries of Epstein's estate potentially receiving tens of millions. Read more.

Despite recent volatility, Nvidia's strong earnings and positive jobs data briefly lifted the market momentum, though later reversals sparked uncertainty about the year-end equity valuation. Read more.

Concerns over an AI bubble are growing globally, with Chinese markets underperforming and adding pressure on tech sector valuations worldwide. Read more.

The Federal Reserve is closely watched amid speculation about a possible interest rate cut in December, with market expectations shifting significantly over the past week. Read more.

Disclaimer: The content provided by OptionPicks is for informational and educational purposes only and should not be construed as investment, financial, legal, or tax advice. We are not registered as a broker-dealer, investment adviser, or financial advisor with the SEC, FINRA, or any other regulatory authority. Options trading involves substantial risk and is not suitable for every investor. Past performance is not indicative of future results, and no representation is being made that any subscriber will or is likely to achieve profits or incur losses similar to those mentioned. You should consult with a licensed financial professional before making any investment decisions.