Here’s what’s happening in the stock market today:

The stock market is showing cautious mixed moves today as investors digest some recent declines and await key economic data. Futures for the Dow Jones, S&P 500, and Nasdaq are relatively stable with minor gains, rebounding slightly after a rough start to December. The tech-heavy Nasdaq has been volatile, trading with slight increases after steep losses last week. Bitcoin remains subdued below $90,000, reflecting ongoing risk-aversion. Gold and silver prices continue to surge amid inflation concerns, while crude oil prices remain elevated following OPEC+ output decisions.

Major Indices Performance 📊

Nasdaq futures gained slightly by about 0.1%, recovering from a 0.4% drop at the start of December.

S&P 500 and Dow Jones futures are nearly unchanged, following losses of roughly 0.5% and 0.9% respectively on Monday.

The stock market opened December with a pullback after a five-day winning streak, reflecting caution amid inflation and valuation worries.

Market Movers 🚀

Apple shares climbed around 0.8%, buoyed by positive AI leadership outlook.

Semiconductor firms like Synopsys gained close to 4.85%, with Nvidia rebounding 1.5% following optimistic demand outlooks for China.

Some notable gainers in the S&P 500 include DoorDash (+3.6%), J.B. Hunt Transport (+3.3%), and AppLovin (+4%).

Crypto-related stocks like Coinbase fell along with Bitcoin's retreat.

Key Events Driving the Market 🗞️

Investors await important economic reports this week, including the delayed release of September's Consumption Expenditures index, a key Fed inflation measure.

The Federal Reserve interest rate outlook remains central, with more than 85% of investors expecting a quarter-point rate cut at the Fed meeting next week.

President Trump has announced he selected a candidate to succeed Jerome Powell as Fed Chair, adding uncertainty to market sentiment.

OPEC+ has maintained crude oil production levels, contributing to higher oil prices that fuel inflation concerns.

Investor Sentiment 👀

Investors are exhibiting caution with subdued trading volumes, balancing optimism over possible rate cuts against inflation and geopolitical uncertainties. The market reflects a blend of cautious optimism from recent strong gains and concern over valuation, Fed leadership changes, and persistent inflation pressures. The potential absence of a "Santa Claus rally" this December adds to the cautious mood among traders and investors.

All figures and market context are based on the latest data as of today, December 2, 2025.

Become An AI Expert In Just 5 Minutes

If you’re a decision maker at your company, you need to be on the bleeding edge of, well, everything. But before you go signing up for seminars, conferences, lunch ‘n learns, and all that jazz, just know there’s a far better (and simpler) way: Subscribing to The Deep View.

This daily newsletter condenses everything you need to know about the latest and greatest AI developments into a 5-minute read. Squeeze it into your morning coffee break and before you know it, you’ll be an expert too.

Subscribe right here. It’s totally free, wildly informative, and trusted by 600,000+ readers at Google, Meta, Microsoft, and beyond.

TRADE OF THE DAY:

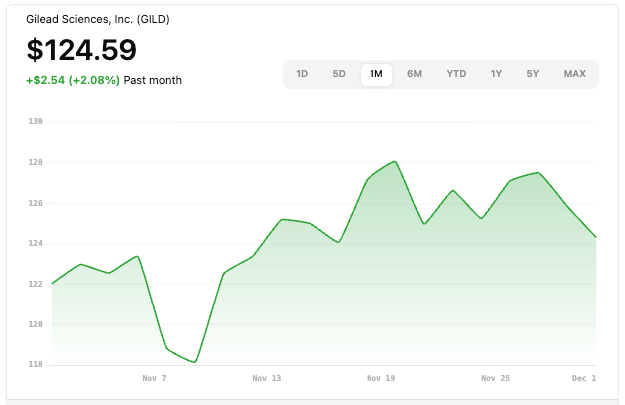

GILD

Name: Gilead Sciences, Inc.

Symbol: GILD

Current Price: ~$124.59

Trade

Sell to Open: 1 GILD Dec 19, 2025 118/115 Put Vertical (Bull Put)

Total Credit Received: $45.00

Credit per Contract: $45.00

Direction: Bullish

Probability of Profit (PoP): 83.64%

Potential ROI:

Max Risk (Loss): $255.00

ROI: ($45.00 ÷ $255.00) × 100 ≈ 17.6%

Trade Explained in Simple English:

This trade sells the 118 put and buys the 115 put expiring December 19, 2025, generating $45 upfront. You profit if GILD stays above about $117.55 at expiration, causing both puts to expire worthless. Your downside is limited to a maximum loss of $255 if GILD falls below $115. This is a bullish position because it benefits from the stock staying above the short strike.

Wall Street Highlights:

News Beyond the Numbers

Netflix has tapped investment bank Moelis & Co. to explore a potential bid for Warner Bros. Discovery's studio and streaming business, gaining access to key financial data while expressing no interest in its cable networks. Read more.

Palantir partnered with Exiger to deliver AI-powered supply chain tools to the U.S. Army, integrating Palantir's AI platform with Exiger's analytics for enhanced battlefield readiness and risk management. Read more.

CrowdStrike is set to report its Q3 2026 earnings after market close today, with analysts anticipating revenue of around $958 million and EPS of $0.29 amid focus on AI contributions and growth strategies. Read more.

President Trump has reportedly selected his preferred successor to Fed Chair Jerome Powell, with White House economic advisor Kevin Hassett emerging as the leading candidate ahead of Powell's term end. Read more.

Electronic Arts went private in a record $55 billion LBO led by Silver Lake, PIF, and Affinity, marking a major shift toward private ownership for IP-rich gaming companies. Read more.

Disclaimer: The content provided by OptionPicks is for informational and educational purposes only and should not be construed as investment, financial, legal, or tax advice. We are not registered as a broker-dealer, investment adviser, or financial advisor with the SEC, FINRA, or any other regulatory authority. Options trading involves substantial risk and is not suitable for every investor. Past performance is not indicative of future results, and no representation is being made that any subscriber will or is likely to achieve profits or incur losses similar to those mentioned. You should consult with a licensed financial professional before making any investment decisions.