Here’s what’s happening in the stock market today:

The stock market today is showing modest gains as investors are encouraged by growing expectations of a Federal Reserve interest rate cut next week. US stock futures point to a slightly positive open, with the S&P 500, Dow Jones, and Nasdaq all poised to edge higher. Technology stocks and crypto markets, led by firms like Apple, Nvidia, and Microsoft, are among the key drivers supporting the market rebound after recent losses.

Major Indices Performance 📊

S&P 500 futures are up about 0.2%, with the index attempting a rebound from recent dips.

Dow Jones futures are gaining modestly, along with a 150-point rise observed in the previous session.

Nasdaq futures are also up around 0.3%, buoyed by strong performance in tech stocks.

Market Movers 🚀

Nvidia shares jumped nearly 3%, Oracle rose 3.9%, and Palantir increased over 3%.

Microsoft, Apple, Alphabet, Amazon, and Meta showed moderate gains between 0.2% and 0.5%.

Bitcoin has rebounded significantly, rising about 6% after a recent sharp drop, fueling optimism in crypto-related stocks.

Key Events Driving the Market 🗞️

The Federal Reserve is widely expected to announce a 25 basis points rate cut on December 10, ending quantitative tightening and boosting risk assets.

Upcoming private sector employment data from ADP and the closely watched December Non-Farm Payrolls report will influence market sentiment.

Treasury yields remain elevated, presenting some pressure on equities compared to bonds.

Oil prices have declined slightly, with crude trading around $58.52, easing some inflation worries.

Investor Sentiment 👀

Overall, investor mood is cautiously optimistic, balancing the likelihood of easier monetary policy with ongoing economic data risks and recent volatility in cryptocurrencies. Global cues are mixed, with Asian markets trading in narrow ranges mirroring Wall Street’s performance. Trading volumes remain moderate as traders watch corporate earnings and macroeconomic indicators closely.

This paints a picture of a stock market in recovery mode today, fueled by hopes of policy support but alert to risks from economic data and geopolitical developments.

The Smartest Free Crypto Event You’ll Join This Year

Curious about crypto but still feeling stuck scrolling endless threads? People who get in early aren’t just lucky—they understand the why, when, and how of crypto.

Join our free 3‑day virtual summit and meet the crypto experts who can help you build out your portfolio. You’ll walk away with smart, actionable insights from analysts, developers, and seasoned crypto investors who’ve created fortunes using smart strategies and deep research.

No hype. No FOMO. Just the clear steps you need to move from intrigued to informed about crypto.

TRADE OF THE DAY:

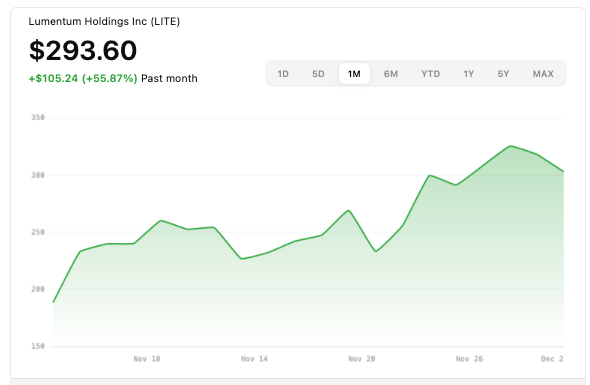

LITE

Name: Lumentum Holdings Inc.

Symbol: LITE

Current Price: ~$293.60

Trade

Sell to Open: 1 LITE Dec 12, 2025 247.5/242.5 Put Vertical (Bull Put)

Total Credit Received: $52.00

Credit per Contract: $52.00 (1 contract = 100 shares)

Direction: Bullish (expects LITE to stay above the break-even level)

Probability of Profit (PoP): 84.56%

Potential ROI:

Max Risk (Loss): $448.00

ROI: ($52.00 ÷ $448.00) × 100 ≈ 11.6%

Trade Explained in Simple English:

This trade sells the 247.5 put and buys the 242.5 put expiring December 12, 2025. You collect $52 upfront, and the trade profits if LITE stays above about $246.78, allowing both options to expire worthless. Your maximum loss is capped at $448 if the stock finishes at or below $242.50. Because you want LITE to stay above the short strike, this is a bullish position.

Wall Street Highlights:

News Beyond the Numbers

Marvell Technology announced a definitive agreement to acquire semiconductor startup Celestial AI for $3.25 billion in cash and stock, with potential upside to $5.5 billion, aiming to bolster its AI networking capabilities. Read more.

Anthropic, the AI firm behind the Claude chatbot, is preparing for a potential IPO as early as 2026 while negotiating a private funding round that could value it over $300 billion. Read more.

The Baldwin Group agreed to buy rival insurance broker CAC Group in a $1.03 billion cash-and-stock deal, gaining expertise in key sectors and projecting over $2 billion in combined annual revenue. Read more.

MongoDB reported third-quarter earnings and revenue that beat Wall Street estimates, with $628 million in sales up 19% year-over-year, prompting raised full-year guidance. Read more.

Warner Bros. Discovery received revised binding acquisition bids from Paramount, Comcast, and Netflix around its bidding deadline, with CEO David Zaslav eyeing a possible deal by year-end. Read more

Disclaimer: The content provided by OptionPicks is for informational and educational purposes only and should not be construed as investment, financial, legal, or tax advice. We are not registered as a broker-dealer, investment adviser, or financial advisor with the SEC, FINRA, or any other regulatory authority. Options trading involves substantial risk and is not suitable for every investor. Past performance is not indicative of future results, and no representation is being made that any subscriber will or is likely to achieve profits or incur losses similar to those mentioned. You should consult with a licensed financial professional before making any investment decisions.