Here’s what’s happening in the stock market today:

The stock market is showing modest gains in pre-market trading on December 5, 2025, with S&P 500 and Nasdaq futures up around 0.2-0.4% ahead of key PCE inflation data that could influence Federal Reserve rate expectations. Dow Jones futures remain largely flat after a mixed close yesterday, where the S&P 500 edged up 0.11%, Nasdaq rose 0.22%, and Dow dipped 0.07%.

Major Indices Performance 📊

S&P 500 futures up 0.2%, with the index near recent highs amid Fed rate cut optimism.

Nasdaq 100 futures advancing 0.4%, driven by tech sector resilience.

Dow Jones futures unchanged, reflecting broader market caution.

Market Movers 🚀

Salesforce (CRM) leads gainers with +3.62% pre-market momentum.

Western Digital (WDC) up 3.56%, alongside Meta Platforms (META) at +3.43%.

Williams Companies (WMB) rises 3.43% amid energy sector interest.

Key Events Driving the Market 🗞️

Traders await the Fed-favored PCE inflation report, delayed but pivotal for rate cut prospects next week. Recent labor data tempers enthusiasm, while Ulta Beauty surges pre-market on strong results and holiday optimism. Treasury yields and global indices like a declining Nikkei add mixed signals.

Investor Sentiment 👀

Caution prevails with focus on inflation metrics and Fed policy, blending rate cut hopes against economic data volatility. Trading volume stays subdued early, positioning markets for potential swings post-PCE release.

The Smartest Free Crypto Event You’ll Join This Year

Curious about crypto but still feeling stuck scrolling endless threads? People who get in early aren’t just lucky—they understand the why, when, and how of crypto.

Join our free 3‑day virtual summit and meet the crypto experts who can help you build out your portfolio. You’ll walk away with smart, actionable insights from analysts, developers, and seasoned crypto investors who’ve created fortunes using smart strategies and deep research.

No hype. No FOMO. Just the clear steps you need to move from intrigued to informed about crypto.

TRADE OF THE DAY:

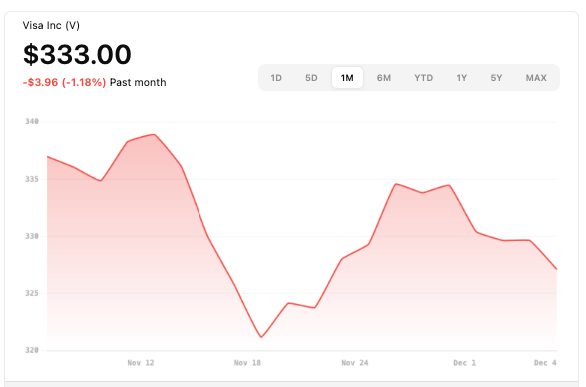

V

Name: Visa Inc.

Symbol: V

Current Price: ~$333.00

Trade

Sell to Open: 1 V Dec 19, 2025 345/350 Call Vertical (Bear Call Spread)

Total Credit Received: $53.00

Credit per Contract: $53.00 (for one contract covering 100 shares)

Direction: Bearish (expects V to stay below strike + credit threshold)

Probability of Profit (PoP): 83.78%

Potential ROI:

Max Risk (Loss): $447.00

ROI: ($53.00 ÷ $447.00) × 100 ≈ 11.9%

Trade Explained in Simple English:

You sold the 345-strike call and bought the 350-strike call expiring Dec 19, 2025. You collect a $53 credit upfront. If Visa stays below about $345.53 by expiration, both calls expire worthless and you keep the credit as your profit. Your maximum loss is capped at $447 if Visa rises above 350. This trade is bearish — you are betting the stock won’t climb past 345.53.

Wall Street Highlights:

News Beyond the Numbers

Film producers are lobbying Congress to block Netflix's potential acquisition of Warner Bros. Discovery, citing risks of an economic and institutional crisis in Hollywood. Read more.

Warner Bros. Discovery and Netflix have entered exclusive negotiations for a $72 billion deal involving cash and stock, separating studios and HBO Max from cable networks. Read more.

Apple announced the retirement of two top executives, Lisa Jackson and Kate Adams, amid a wave of departures among its senior leaders. Read more.

Private equity firms drove record-breaking M&A activity in the RIA and wealth management sectors during the first three quarters of 2025, with deal volume reaching $1.2 trillion in assets under management. Read more.

Copper giant Freeport-McMoRan's CEO stated the company won't rely on mergers for growth, focusing instead on developing its existing assets despite potential acquisition opportunities. Read more.

Disclaimer: The content provided by OptionPicks is for informational and educational purposes only and should not be construed as investment, financial, legal, or tax advice. We are not registered as a broker-dealer, investment adviser, or financial advisor with the SEC, FINRA, or any other regulatory authority. Options trading involves substantial risk and is not suitable for every investor. Past performance is not indicative of future results, and no representation is being made that any subscriber will or is likely to achieve profits or incur losses similar to those mentioned. You should consult with a licensed financial professional before making any investment decisions.