Here’s what’s happening in the stock market today:

The stock market shows steady to slightly positive futures early Friday amid mixed global signals and year-end positioning, following Thursday's rebound driven by softer inflation data. Major U.S. indexes like the S&P 500 and Nasdaq snapped losing streaks yesterday, but face weekly losses in the final full trading week of 2025.

Major Indices Performance 📊

S&P 500 futures hold near unchanged to slightly up, with the index at around 6,784 after a 0.93% gain yesterday.

Dow Jones futures are up modestly at 48,016, reflecting a 0.59% rise in the prior session.

Nasdaq futures lead with gains, fueled by tech recovery after climbing 1.37-1.43% Thursday.

Market Movers 🚀

Nike slides in premarket on forecasts of sales decline.

Micron Technology boosted Nasdaq gains yesterday with strong earnings as a memory chip leader.

Broader tech rally supports Nasdaq outperformance, though specific top gainers/losers remain subdued pre-open.

Key Events Driving the Market 🗞️

November inflation fell to 2.7%, the lowest since July and below expectations, aiding Thursday's rally and Fed rate cut hopes.

Japan's rate hike spurs higher bond yields globally, with U.S. 10-year Treasury at 4.15%.

Triple-witching expiration and year-end flows add volatility; Bitcoin hovers near $88,000 while gold dips from peaks.

Investor Sentiment 👀

Traders balance optimism from inflation relief and tech rebounds against weekly losses and elevated yields. Volume stays moderate as markets eye close of a challenging December.

7 Actionable Ways to Achieve a Comfortable Retirement

Your dream retirement isn’t going to fund itself—that’s what your portfolio is for.

When generating income for a comfortable retirement, there are countless options to weigh. Muni bonds, dividends, REITs, Master Limited Partnerships—each comes with risk and oppor-tunity.

The Definitive Guide to Retirement Income from Fisher investments shows you ways you can position your portfolio to help you maintain or improve your lifestyle in retirement.

It also highlights common mistakes, such as tax mistakes, that can make a substantial differ-ence as you plan your well-deserved future.

TRADE OF THE DAY:

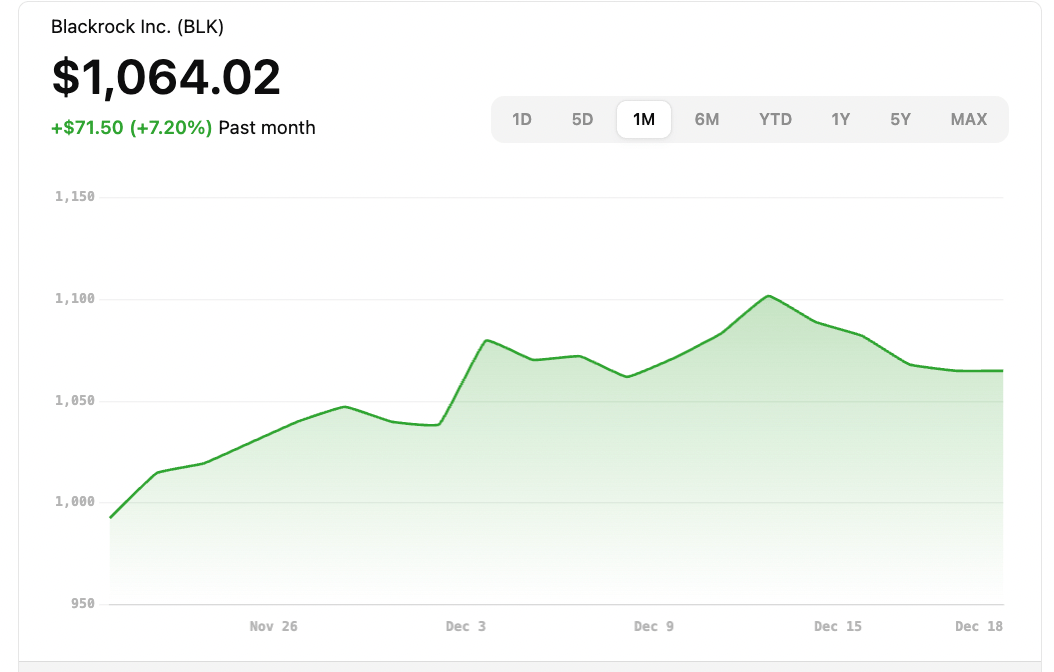

BLK

Name: BlackRock, Inc.

Symbol: BLK

Current Price: ~$1,064.02 (latest U.S. market price)

Trade

Sell to Open: 1 BLK Jan 2, 2026 1105/1110 Call Vertical (Bear Call Spread)

Total Credit Received: $65.00

Credit per Contract: $65.00 (1 contract = 100 shares)

Direction: Bearish (expects BLK to stay below short strike)

Probability of Profit (PoP): 84.44% (as provided)

Potential ROI

Max Risk (Loss): $435.00 (given)

ROI: ($65.00 ÷ $435.00) × 100 ≈ 15.0%

Trade Explained in Simple English:

You sold a bearish call vertical on BLK by selling the 1105 strike call and buying the 1110 strike call, both expiring January 2, 2026, collecting $65 in credit upfront. This strategy will profit if BLK stays below about $1,105.65 at expiration; you keep the credit if the options expire worthless. Your maximum loss is capped at $435 if BLK rises above the 1110 strike, and the potential return on your risk is about 15.0%.

Wall Street Highlights:

News Beyond the Numbers

Oracle shares surged more than 5% pre-market after TikTok agreed to separate its U.S. operations from ByteDance, positioning Oracle to potentially acquire the app amid ongoing negotiations.[ Read more.](https://finance.yahoo.com/news/live/stock-market-today-dow-sp-500-nasdaq-futures-rise-with-wall-street-set-to-wrap-up-latest-vol ...)

Micron Technology reported strong earnings that beat Wall Street expectations, fueling a tech rally driven by demand in memory chips. Read more.

FedEx exceeded fiscal second-quarter earnings and revenue forecasts with $4.54 per share and $23.47 billion, pushing shares toward a 52-week high. Read more.

Nike beat second-quarter earnings and revenue estimates thanks to robust North American sales growth, despite a sharp drop in Greater China revenue. Read more.

Wall Street dealmakers face uncertainty in 2025 M&A activity due to President Trump's tariffs, falling short of expected post-election transaction surges. Read more.

Disclaimer: The content provided by OptionPicks is for informational and educational purposes only and should not be construed as investment, financial, legal, or tax advice. We are not registered as a broker-dealer, investment adviser, or financial advisor with the SEC, FINRA, or any other regulatory authority. Options trading involves substantial risk and is not suitable for every investor. Past performance is not indicative of future results, and no representation is being made that any subscriber will or is likely to achieve profits or incur losses similar to those mentioned. You should consult with a licensed financial professional before making any investment decisions.